View:

May 13, 2024

China RRR and Rate Cuts

May 13, 2024 7:54 AM UTC

The latest China money supply and lending figures show that private household and business lending is very subdued. More need to be done to boost credit demand as well as credit supply. However, the authorities desires to avoid too much Yuan weakness will likely mean that the next move is a 25bp

May 10, 2024

Asset Allocation 2024: Tricky Seven Months Remaining

May 10, 2024 1:06 PM UTC

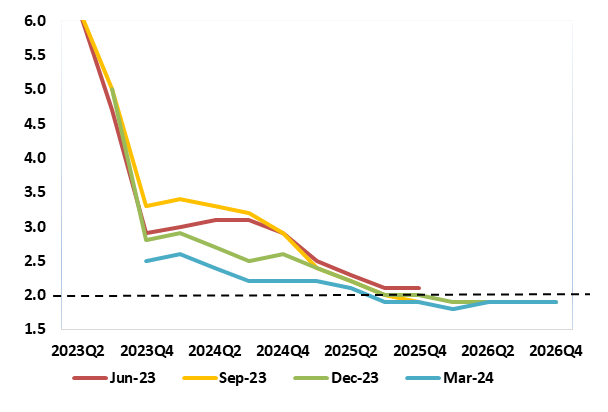

Fed easing expectations for 2025 and 2026 can shift from a terminal 4% Fed Funds rate towards 3%, as the U.S. economy slows due to lagged tightening effects. Combined with Fed easing starting in September this should mean a consistent decline in 2yr yields. However, 10yr U.S. Treasury yields wil

May 09, 2024

BCB Review: 25bps Cut, No Additional Guidance

May 9, 2024 1:11 PM UTC

The Brazilian Central Bank convened, opting against a 50bps cut, reducing it to 25bps, lowering the policy rate to 10.5%. A split vote ensued, with 25bps winning 5x4. The communique, vague possibly due to board division, noted labor market and economic activity surpassing expectations. Foreign marke

May 08, 2024

China Equities: A Tactical Play

May 8, 2024 2:20 PM UTC

China equities can see a tactical bounce of 5-10% in the coming months. Cheap valuations and underweight global fund positions means that the scale of pessimism only has to get less bad on the economy and China authorities attitude towards businesses. While we see a tactical opportunity, we do

Sweden Riksbank Review: Biting the Bullet

May 8, 2024 8:24 AM UTC

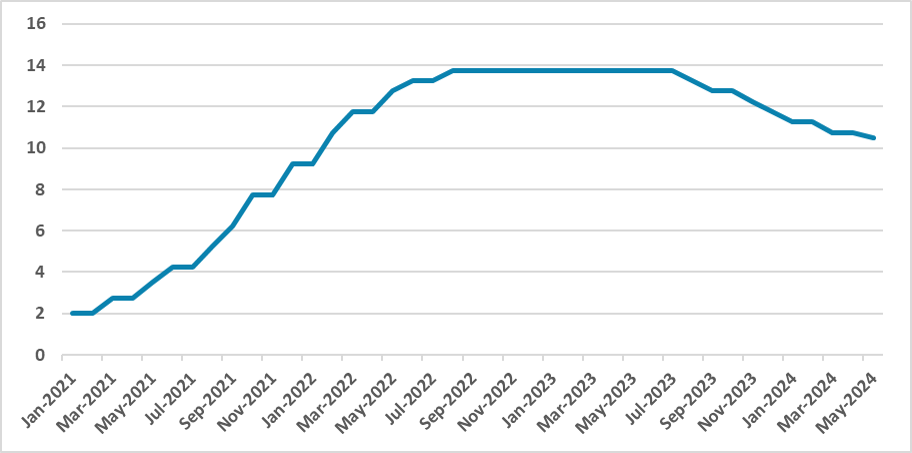

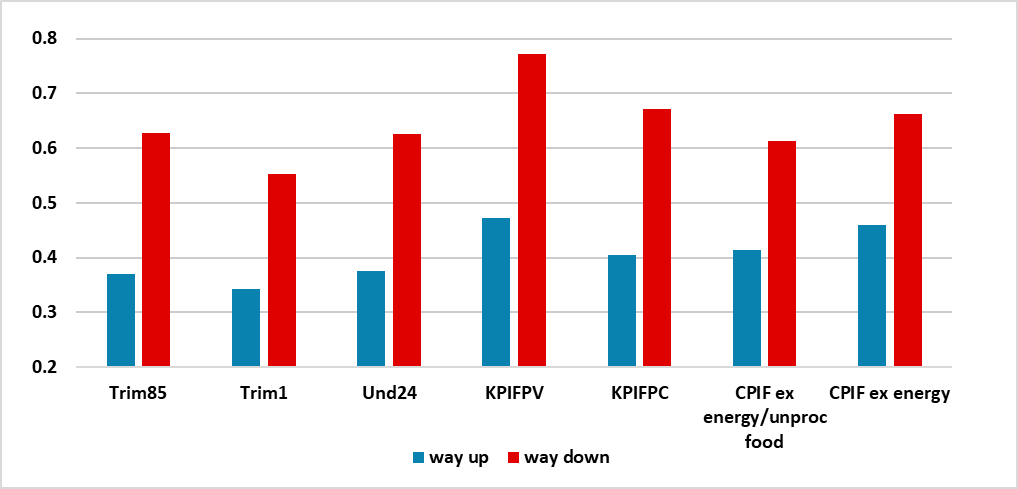

It very much seemed to be a question of when, not if, as far as policy easing is concerned for the Riksbank. In this regard, albeit surprising in terms of timing, the Riksbank delivered, cutting its policy rate by 25 bp (to 3.75%), despite clear concerns it has flagged about recent and continued k

May 07, 2024

U.S. Fiscal Problems: 2025 More Than 2024

May 7, 2024 1:10 PM UTC

Current real yields in the U.S. government bond market already large reflect the large government deficit trajectory. Even so, H1 2025 could see some extra fiscal tensions that add 30-40bps to 10yr U.S. Treasury yields as the post president election environment will either see a reelected Joe Bide

May 03, 2024

U.S. April ISM Services - Weakness may be overstated

May 3, 2024 2:24 PM UTC

April’s ISM services index of 49.4 from 51.4 has fallen below neutral for the first time since December 2022. That dip was explained by bad weather. There is no obvious erratic factor here to explain the weakness, but the details suggests that weakness may be overstated.

EMFX: Diverging On Domestic Forces Not Less Fed Easing Hopes

May 3, 2024 10:45 AM UTC

While U.S. economic developments, plus Fed policy prospects, will be important in terms of EM currency developments, domestic politics and fundamentals will also be decisive. These can keep the South Africa Rand volatile in the remainder of 2024, given the risk of a coalition government and African

May 02, 2024

China Politburo: Help for Housing, But No Game changers

May 2, 2024 10:50 AM UTC

Politburo statement in late April suggests extra support for residential property. However, we see this as being incremental rather than any game changers and we still see residential investment remaining a negative drag on 2024 GDP growth.

April 29, 2024

China: Depreciation Rather Than Devaluation

April 29, 2024 1:00 PM UTC

We feel that a devaluation of the Yuan is unlikely in 2024, both to avoid potentially politically destabilizing capital outflows but also to avoid upsetting the next U.S. president. Policy is geared more towards controlled depreciation to help competiveness but reduce other risks. The Yuan has a

April 26, 2024

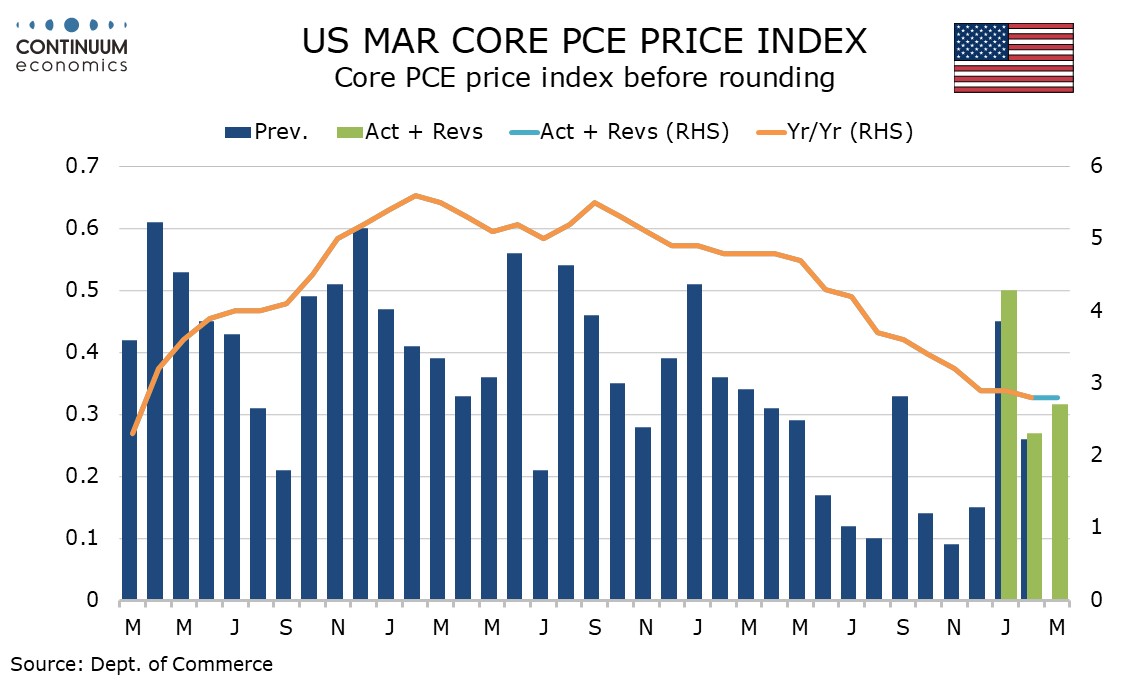

U.S. March Personal Income and Spending - Q1 totals confirmed, Core PCE Prices provide some relief

April 26, 2024 1:12 PM UTC

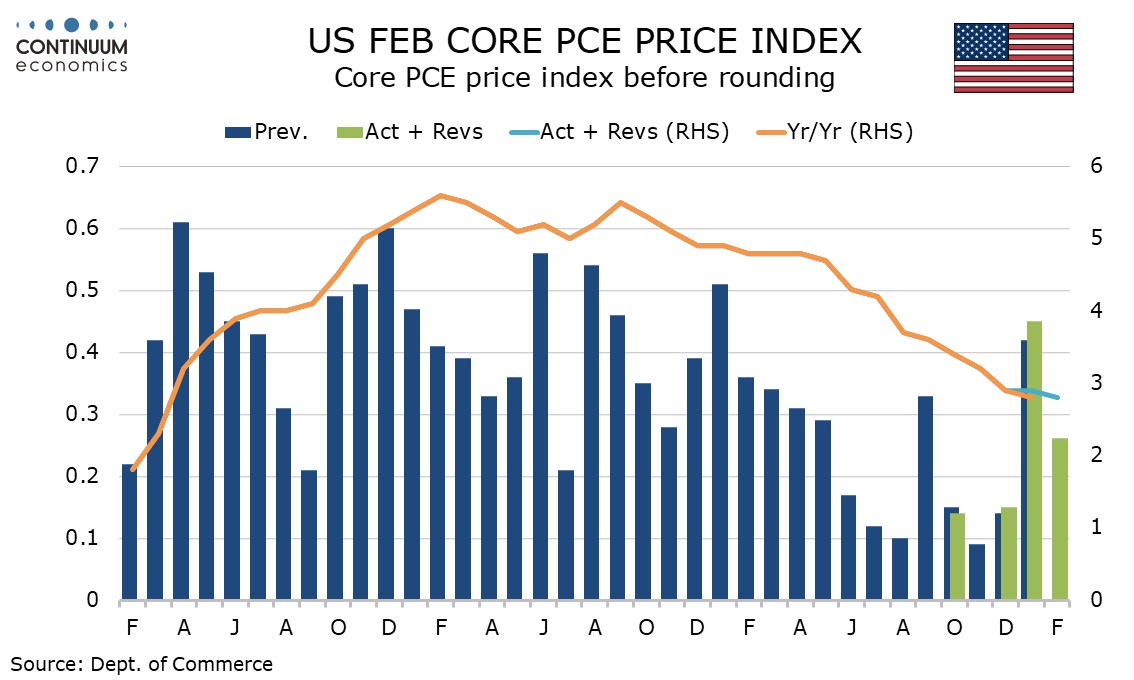

March’s personal income and spending data confirms the Q1 totals released with the GDP report. Core PCE prices at 0.3% provide some relief by avoiding the 0.4% implied by Q1’s stronger than expected 3.7% annualized rise. March rose by 0.317% before rounding with revisions to February (to 0.266%

April 25, 2024

April 24, 2024

U.S. March Durable Goods Orders - Underlying trend still near flat

April 24, 2024 12:51 PM UTC

March durable goods orders are in line with expectations with a 2.6% increase overall, 0.2% ex transport, keeping trend near flat, with non-defense capital ex aircraft seeing similarly modest 0.2% increases in both orders and shipments.

April 23, 2024

April 22, 2024

Short-end European Government Bonds Following U.S. But June Decoupling

April 22, 2024 1:15 PM UTC

The Fed’s shift to higher for longer has spilled over to drag European government bond yields higher through April. This now looks overdone as a June ECB rate cut is not fully discounted and ECB officials/data clearly point towards a 25bps cut. UK money markets are more out of line, with a Jun

April 19, 2024

April 18, 2024

China and the South China Sea

April 18, 2024 2:00 PM UTC

Bottom Line: A China coastguard vessel blocked two Philippines government vessels over the weekend in the Second Thomas shoal area near the Philippines, which has raised questions over whether the South China Sea will be another geopolitical flashpoint. We would say not in 2024, both given China

April 17, 2024

Markets: Fed Rather Than Middle East Worries

April 17, 2024 12:34 PM UTC

Global markets are being driven by a scale back in Fed easing expectations and we see a 5-10% U.S. equity market correction being underway. However, with the market now only discounting one 25bps Fed cut in 2024, any downside surprises on U.S. growth or better controlled monthly inflation numbers

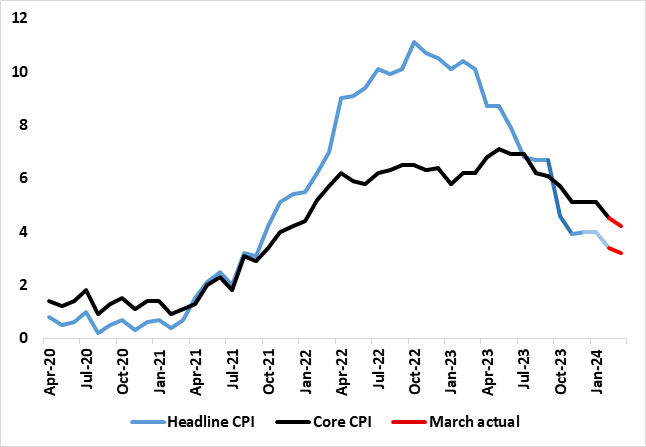

UK CPI Inflation Review: Inflation Fall Further, But Services Momentum Still Evident

April 17, 2024 6:52 AM UTC

UK headline and core inflation have been on a clear downward trajectory in the last few months, the former having peaked above 10% in February last year and the latter at 7.1% In May. After a pause in the preceding three months, this downtrend seemingly resumed in the February CPI numbers and clearl

April 16, 2024

China: Q1 Upside Surprise, but March Disappoints

April 16, 2024 8:33 AM UTC

Q1 GDP upside surprise was driven mainly by public sector investment. With the government still to implement the Yuan 1trn of special sovereign bonds for infrastructure spending, public investment will likely remain a key driving force. However, the breakdown of the March data show that retail s

April 15, 2024

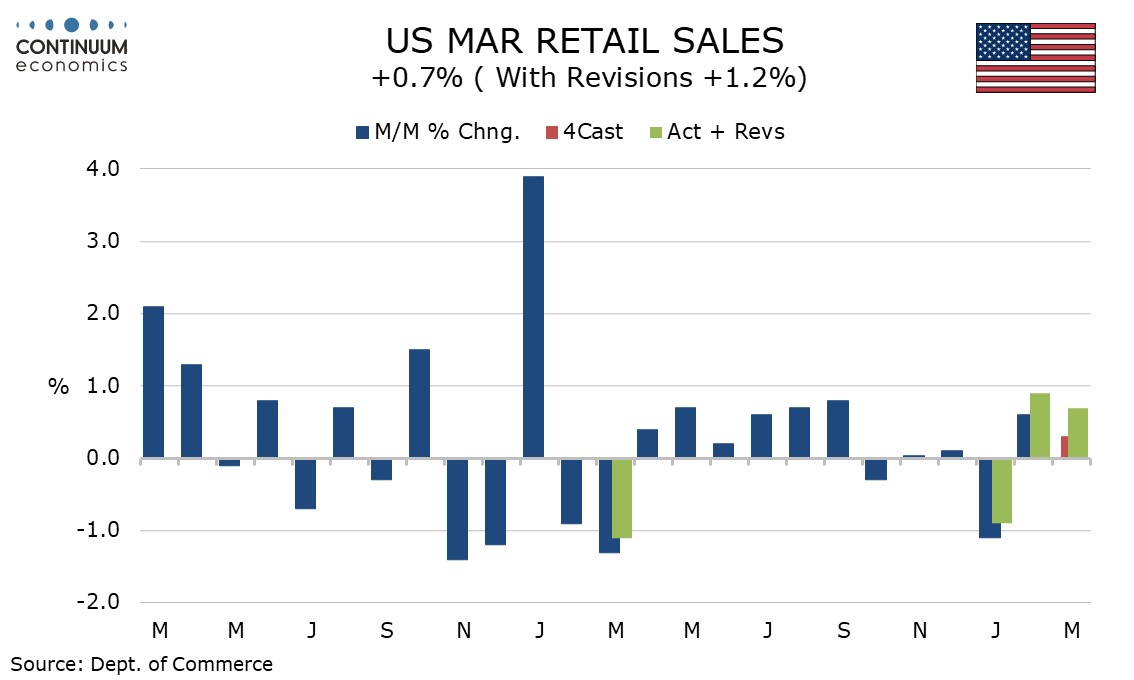

U.S. March Retail Sales allow Q1 to come in marginally positive despite a weak start in January

April 15, 2024 12:56 PM UTC

March retail sales with a 0.7% increase have exceeded expectations despite an expected negative contribution from autos, with sales up by 1.1% both ex autos and in the control group that contributes to GDP, and by 1.0% ex autos and gasoline. This suggest continued consumer momentum entering Q2.

April 10, 2024

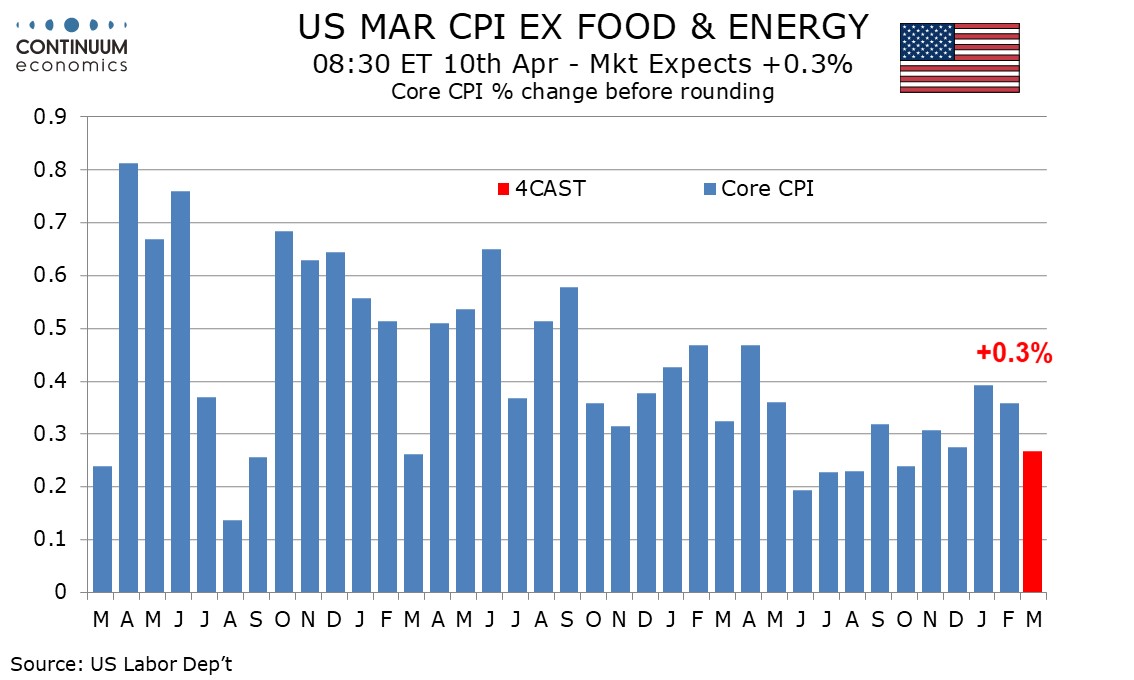

U.S. March CPI - Surprise not dramatic but picture is clearly too high

April 10, 2024 12:55 PM UTC

March CPI has shown a third straight disappointing month at 0.4% overall and ex food and energy, and this suggests that with the economy’s strength persisting, inflation has not yet been defeated, despite the encouraging data seen through the second half of 2023. Still, the market surprise was not

April 09, 2024

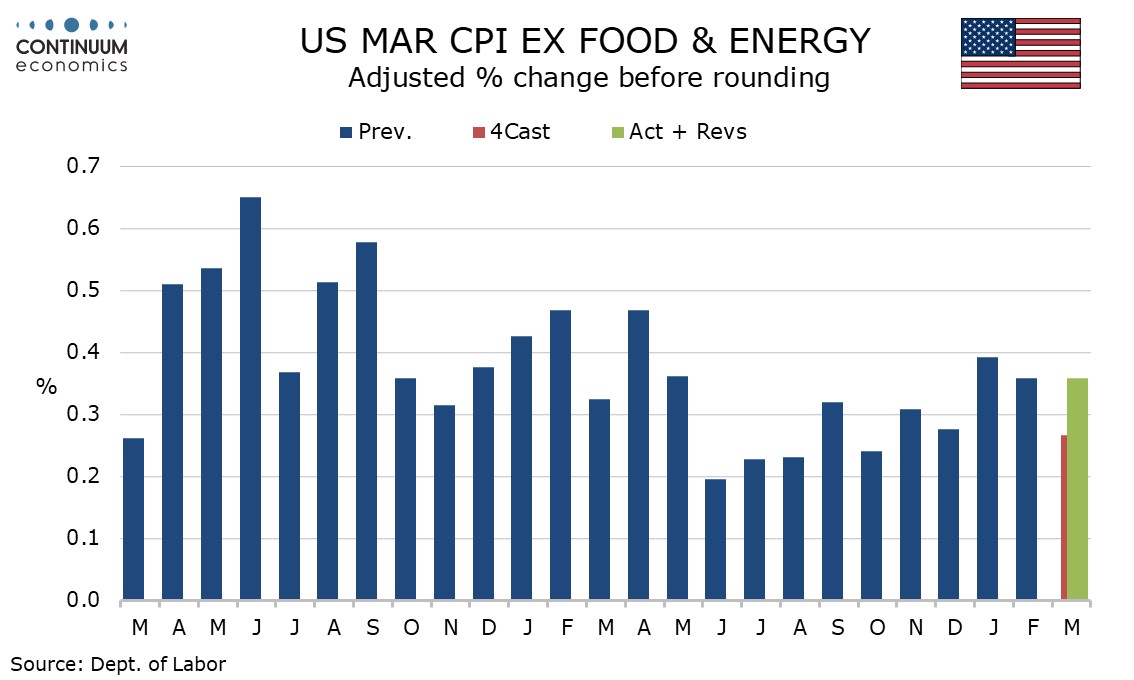

Preview: Due April 10 - U.S. March CPI - Core rate back to trend after two strong months

April 9, 2024 12:27 PM UTC

We expect March CPI to rise by 0.3% both overall and ex food and energy, though before rounding we expect the headline at 0.31% to exceed the core rate at 0.27%, the latter a return to trend after two straight disappointing 0.4% gains seen in January and February.

April 08, 2024

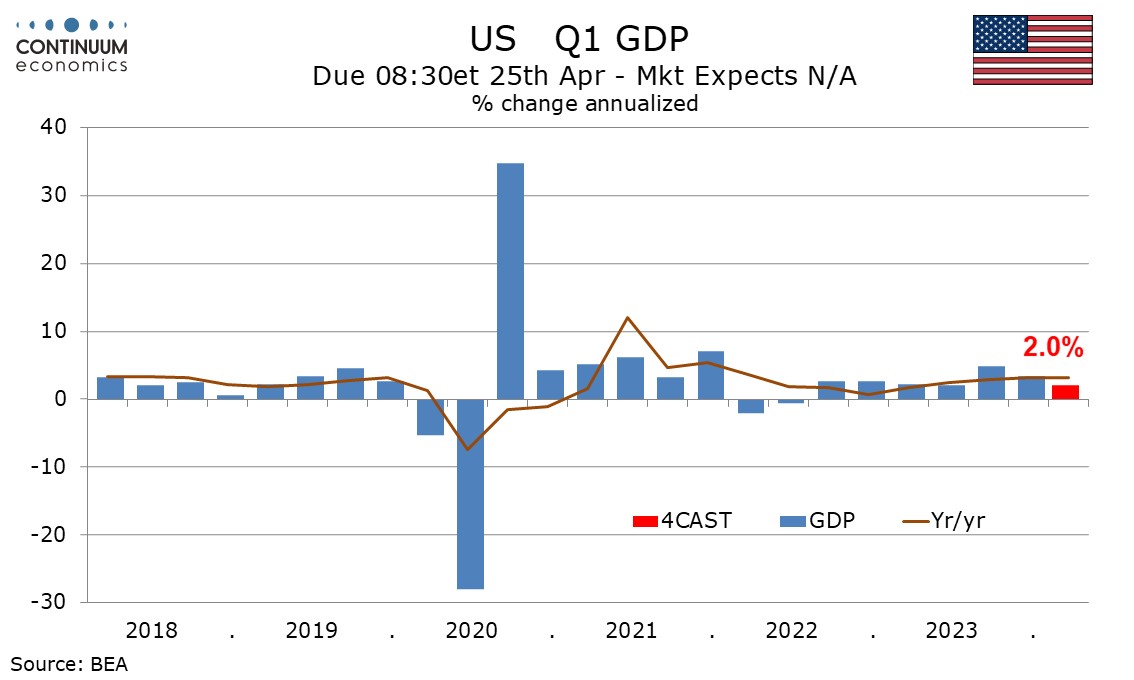

Q1 U.S. GDP Looking Slower But Still With Significant Momentum

April 8, 2024 6:03 PM UTC

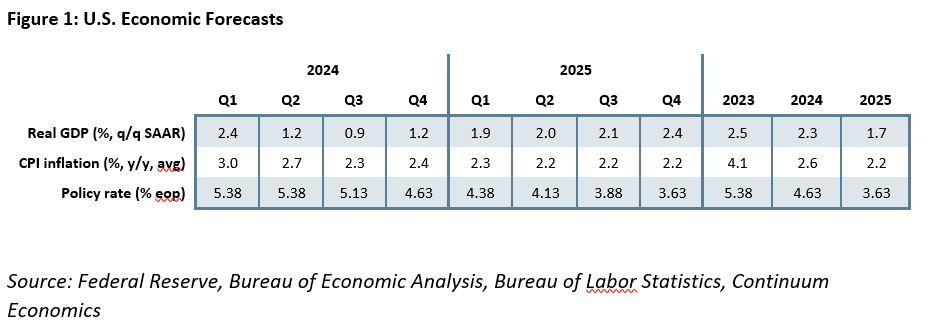

Our Q1 GDP estimate now stands at 2.0% annualized, not much changed from the 2.4% estimate we made in February, though this would now be the slowest quarter since a decline in Q2 2022. The Atlanta Fed’s nowcast is a little stronger than our view at 2.5%, though when we made our 2.4% forecast in Fe

April 04, 2024

ECB Preview (Apr 11): Still the Focus on Words Not Deeds – For Now!

April 4, 2024 12:22 PM UTC

As has been the case for several times now, the ECB meeting verdict due next Thursday (Apr 11) will be notable not for what the Council does but rather what is said just as at the March meeting whose minutes were released today. A fifth successive stable policy decision is very much expected, albe

April 02, 2024

EZ: Labour Costs in Retreat Amid Hoarding and Workforce Jump

April 2, 2024 9:46 AM UTC

It is ever clearer how the labour market (and particularly labour costs) are the dominant theme for the ECB is assessing the policy backdrop and outlook. While HICP inflation continues to subside amid an economy backdrop which is flat at best, the labor market still looks apparently unmoved, with

March 29, 2024

U.S. February Core PCE prices provide some relief, Spending outpaces Income

March 29, 2024 1:07 PM UTC

February’s PCE price data comes as a relief, with a consensus 0.3% core rate up only 0.2615% before rounding, well below a core CPI that was rounded up to 0.4%, while the 0.3% headline (0.333% before rounding) is below consensus, after a strong CPI gain that was rounded down to 0.4%.

March 26, 2024

U.S. February Durable Goods Orders - Trend flat to marginally positive

March 26, 2024 12:48 PM UTC

February durable goods orders are in line with expectations with a 1.4% increase overall, 0.5% ex transport, following declines of 6.9%b and 0.3% respectively in January. Underlying trend ex transport remains near flat though marginally positive. Ex defense saw a 2.2% ruse after a 7.9% January fall.

EM FX Outlook: Domestic Drivers Key

March 26, 2024 9:01 AM UTC

In terms of spot EM FX projections domestic drivers remain critical, with a desire to avoid appreciation versus the USD for some countries. Fed easing in H2 2024 should however help EMFX more broadly and allow some recovery in spot rates (e.g. Indonesian Rupiah (IDR), South African Rand (ZAR)

March 25, 2024

March 22, 2024

U.S. Outlook: Fed to Ease as Economy Gradually Slows

March 22, 2024 10:00 AM UTC

• The U.S. economy has continued to see growth surprising to the upside supported in particular by consumer spending. While the momentum of the second half of 2023 will be difficult to sustain the economy now looks poised for a soft landing, with risk that continued resilience in the econom

March 20, 2024

China Outlook: The Struggle to Hit 5% Growth

March 20, 2024 11:00 AM UTC

China’s 5% growth target will likely be tough to meet with residential property investment likely to knock 1.0-1.5% off GDP and net exports a small negative. With sluggish private investment, this means some of the old engines of growth are not firing. Some additional fiscal stimulus will likely