View:

May 14, 2024

Preview: Due May 22 - U.S. April Existing Home Sales - No signals for a strong move

May 14, 2024 3:29 PM UTC

We expect existing home sales to be unchanged at 4.19m in April, pausing after a 4.3% decline in March corrected a strong 9.5% increase in February. We expect to see trend move lower in the coming months, but there are no clear signals for a second straight decline in April.

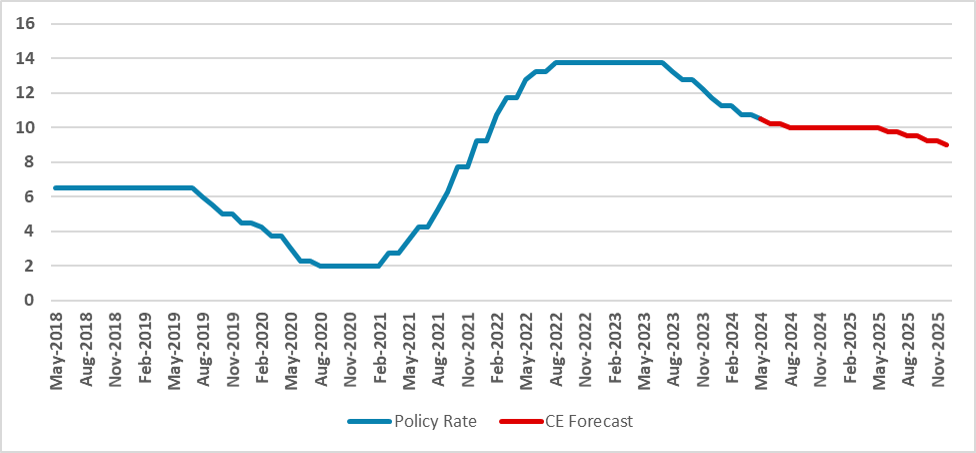

BCB Minutes: Worsening Conditions Demand Caution

May 14, 2024 2:35 PM UTC

The Brazilian Central Bank's latest meeting revealed a shift in forward-guidance, reducing the cut from 50bps to 25bps. While no immediate actions were taken, the minutes highlighted worsening conditions in three key areas: External Environment, Fiscal, and Economic Activity. Despite split votes on

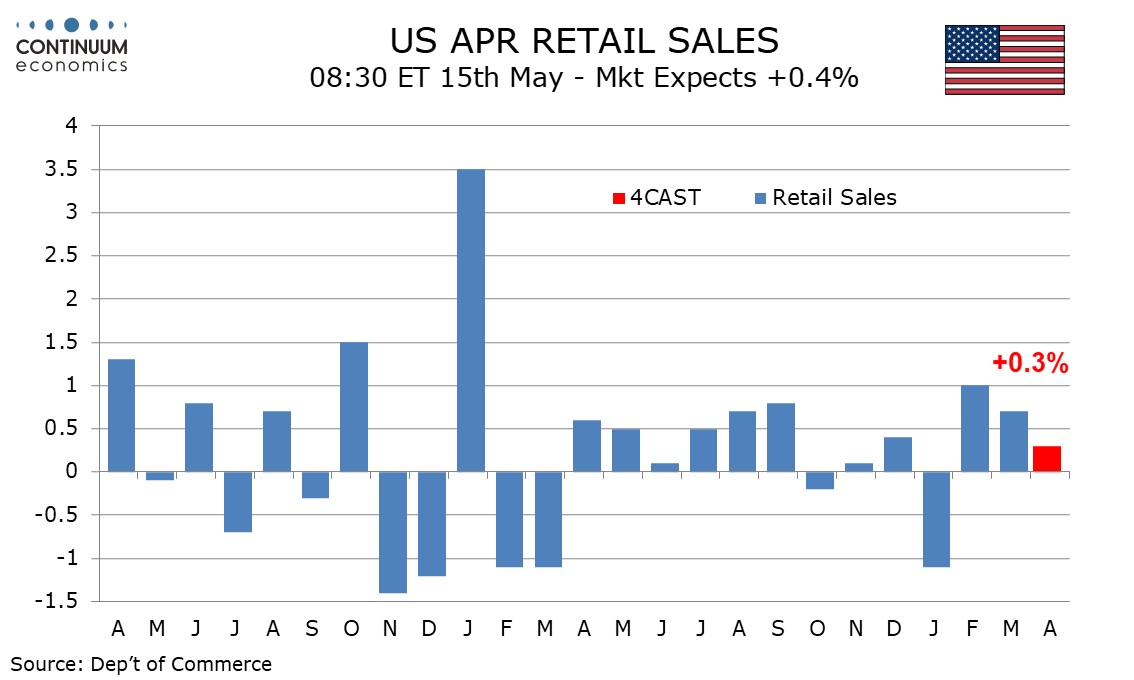

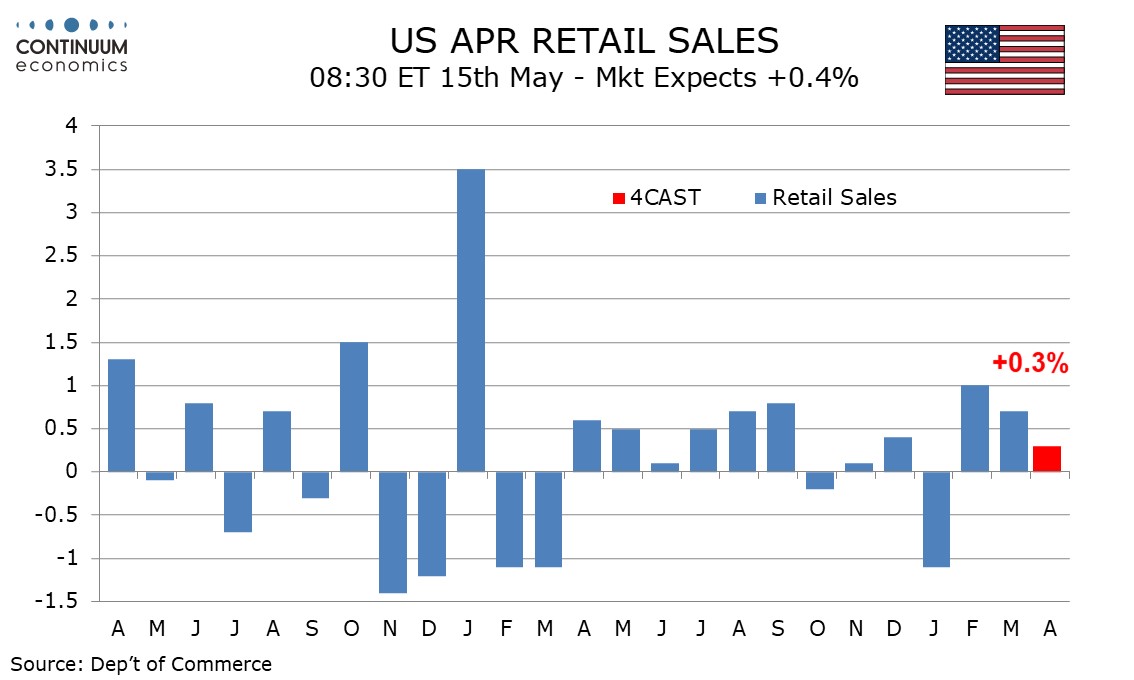

Preview: Due May 15 - U.S. April Retail Sales - Pause after a strong month

May 14, 2024 2:02 PM UTC

After a 0.7% increase in March, we expect April retail sales to rise by only 0.3%. Ex autos we expect a 0.2% increase to follow a 1.1% rise in March, while ex autos and gasoline we expect sales to be unchanged after a 1.0% increase in March which was the strongest since October 2022.

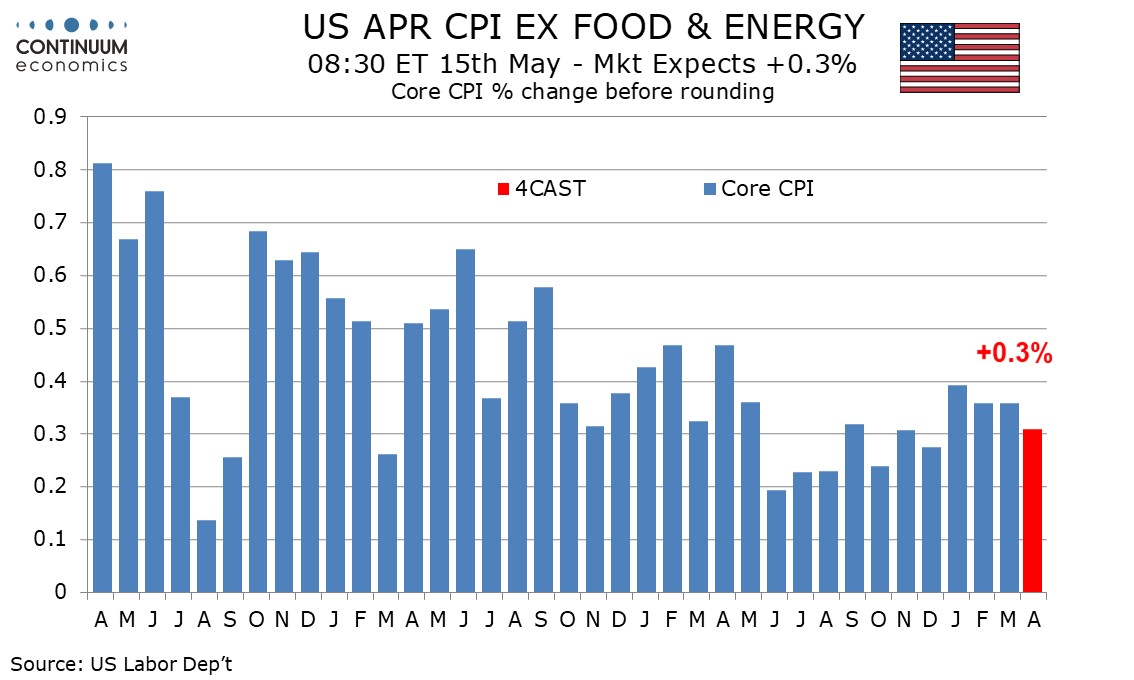

Preview: Due May 15 - U.S. April CPI - Core rate not quite as strong as the preceding three months

May 14, 2024 1:48 PM UTC

We expect April CPI to rise by 0.4% overall for a third straight month but with the ex food and energy pace slowing to 0.3% after three straight months at 0.4%. We expect the strong start to the year to fade as the year progresses, though April PPI strength was disappointing and inflationary pressur

U.S. April PPI - Worrying strength, even if surprise in part offset by March revision

May 14, 2024 1:17 PM UTC

April PPI surprised on the upside with gains of 0.5% overall and ex food and energy, with ex food, energy and trade up by 0.4%. The upside surprise is however largely offset by downward revisions to March, both overall and ex food and energy to -0.1% from +0.2%, though March ex food, energy and tr

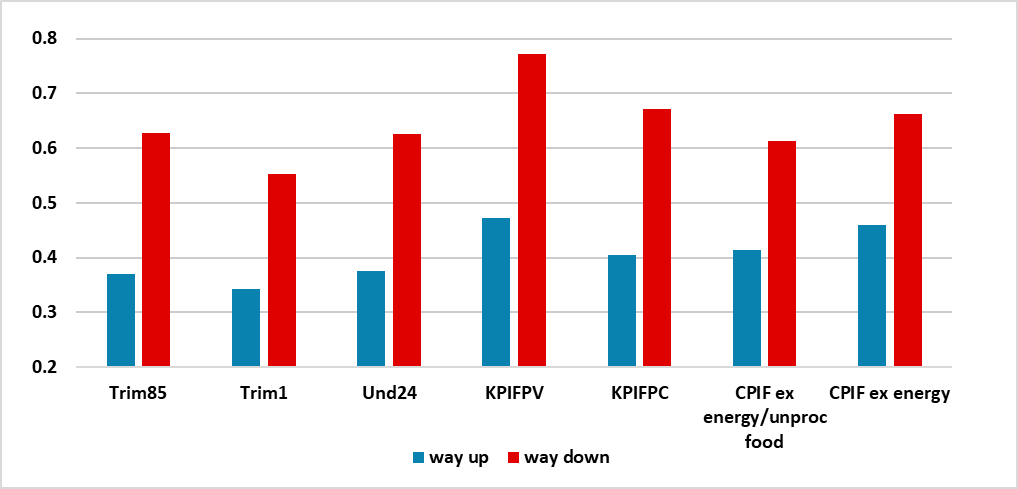

UK Labor Market: Further Signs of Resilient Wage Pressure But Soggier Activity More Notable

May 14, 2024 8:40 AM UTC

As we have underscored repeatedly, the BoE has come to regard the official ONS average earnings data with some suspicion given response rates to the surveys that have fallen towards just 10%. But the BoE will not be able to dismiss the latest earnings data given that alternative (and more author

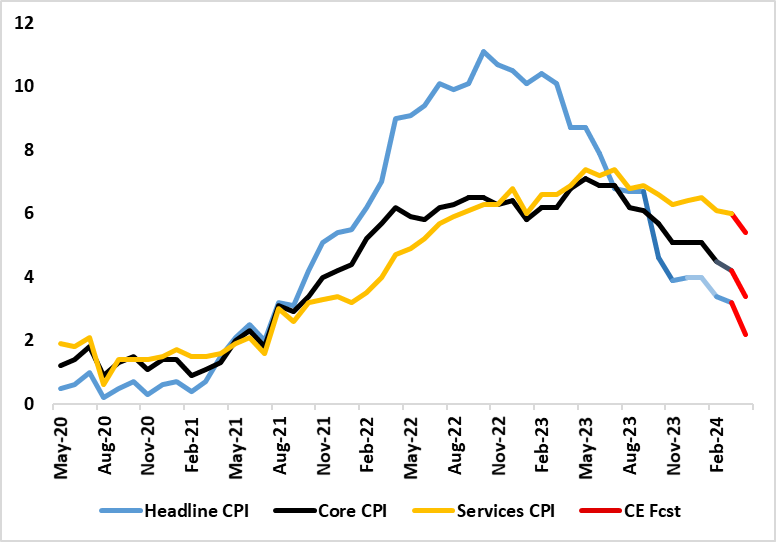

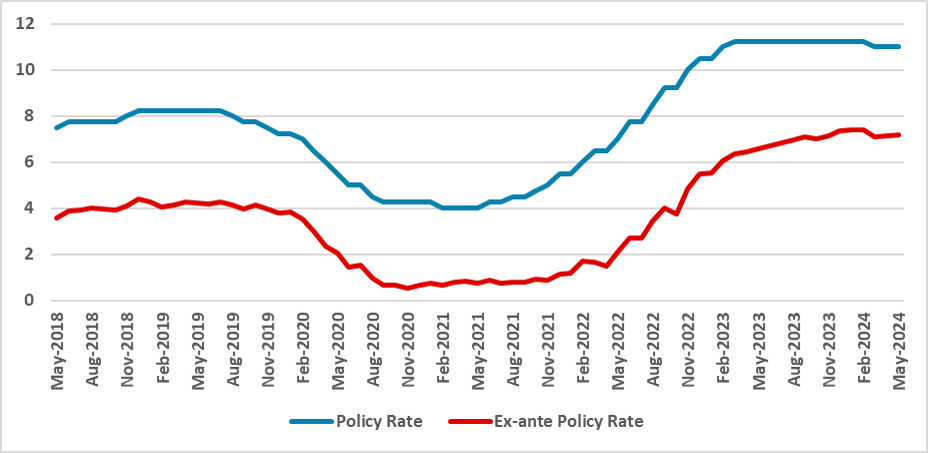

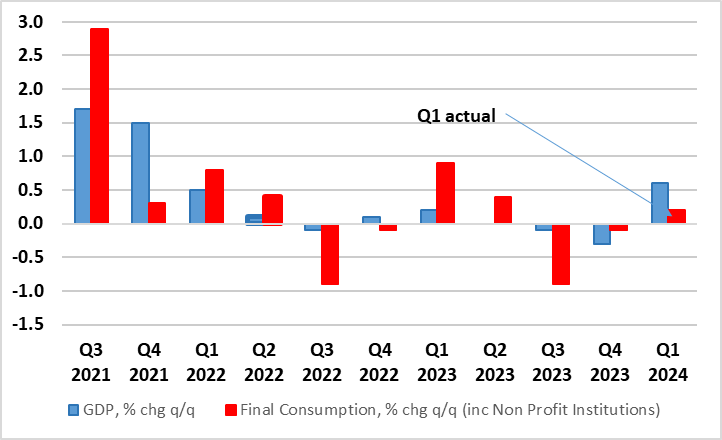

India Inflation Review: Sticky Prices to Keep RBI Cautious

May 14, 2024 3:54 AM UTC

India’s consumer price inflation eased amrginally to 4.83% yr/yr in April, reflecting lower fuel and light prices. The government cut prices of LPG cylinders in India ahead of the elections. However, food price pressures persist despite various supply side measures, underscoring the sticky nature

The Aussie Chapter 3: Risk

May 14, 2024 12:00 AM UTC

In "The Aussie", we will look into the "well-known "correlation among the Aussie and well-known benchmark to give our readers a closer look towards factors that have been affecting the movement of the Australian Dollar. In Chapter 3, we will look into the performance of the Aussie against major equi

May 13, 2024

Preview: Due May 14 - U.S. April PPI - New Year strength fading

May 13, 2024 12:26 PM UTC

We expect a 0.3% increase in April’s PPI, with gains of 0.2% in the core rates ex food and energy and ex food, energy and trade. The core rates would match March’s outcome which slowed from above trend gains in January and February.

UK CPI Inflation Preview (May 22): Inflation to Fall Further and More Broadly

May 13, 2024 12:10 PM UTC

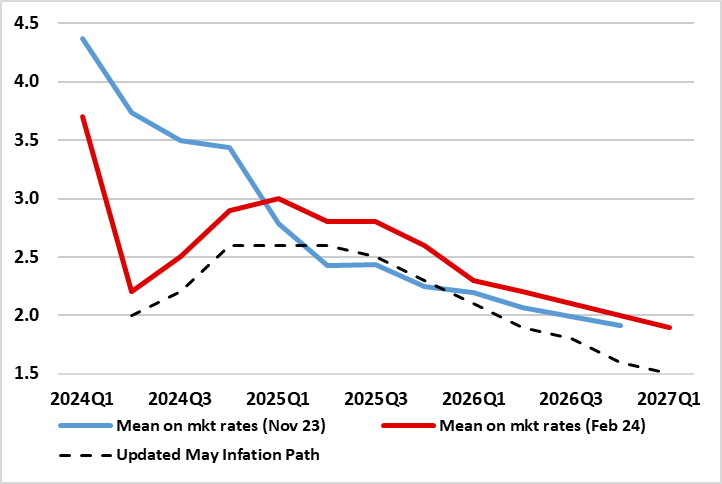

It is very clear that labor market and CPI data are crucial to BoE thinking about the timing and even existence if any start to an easing cycle. But perhaps the CPI data is the most crucial making the looming April data all the more important for markets as they weigh the chances of an initial rat

China RRR and Rate Cuts

May 13, 2024 7:54 AM UTC

The latest China money supply and lending figures show that private household and business lending is very subdued. More need to be done to boost credit demand as well as credit supply. However, the authorities desires to avoid too much Yuan weakness will likely mean that the next move is a 25bp

Watts at Stake: India's Looming Power Shortage

May 13, 2024 6:58 AM UTC

India's power sector faces rising demand and power shortages, sparking fears of the most significant power shortfall in a decade. With coal imports continuing to rise and hydropower generation declining, India's aim to become a manufacturing hub could become challenging. Energy transition is likely

May 10, 2024

Preview: Due May 21 - Canada April CPI - Headline stable but BoC core rates falling

May 10, 2024 2:44 PM UTC

April CPI will be closely watched as the last CPI release before the June 5 Bank of Canada meeting. We expect the yr/yr pace to be unchanged from January at 2.9% which was also the pace in January before February saw a brief dip to 2.8%. However we expect continued steady downward progress in the Bo

U.S. May Michigan CSI - Lowest since November, inflation expectations highest since November

May 10, 2024 2:12 PM UTC

May’s preliminary Michigan CSI of 67.4 from 77.2 is the weakest since November 2023 and hints at a loss of momentum in the economy, but with higher inflation expectations, the 1-year view up significantly to 3.5% from 3.2% and the 5-10 year view up marginally to 3.1% from 3.0%.

Asset Allocation 2024: Tricky Seven Months Remaining

May 10, 2024 1:06 PM UTC

Fed easing expectations for 2025 and 2026 can shift from a terminal 4% Fed Funds rate towards 3%, as the U.S. economy slows due to lagged tightening effects. Combined with Fed easing starting in September this should mean a consistent decline in 2yr yields. However, 10yr U.S. Treasury yields wil

Canada April Employment - Trend still solid, suggesting no urgency for BoC easing

May 10, 2024 12:58 PM UTC

Canada’s 90.4k increase in April employment is well above expectations and raises doubt over the case for a June rate cut, this being the last employment report the Bank of Canada will see before its June 5 meeting. Unemployment was unchanged at 6.1% but wage growth (hourly wage fir permanent empl

Banxico Review: Hold Rates

May 10, 2024 12:44 PM UTC

Banxico's decision to maintain the policy rate at 11% reflects a cautious stance amidst rising inflation and a slowing economy. Despite external volatility, the MXN remains resilient. The main concern is services inflation being stickier. With a revised inflation forecast indicating a longer period

Benign Inflation Allows BNM to Hold Rate

May 10, 2024 9:24 AM UTC

In its latest decision, the Monetary Policy Committee (MPC) of Bank Negara Malaysia (BNM) opted to keep the overnight policy rate (OPR) steady at 3.0%, marking the seventh consecutive meeting without a change. This decision aligns with market projections and underscores BNM's commitment to support g

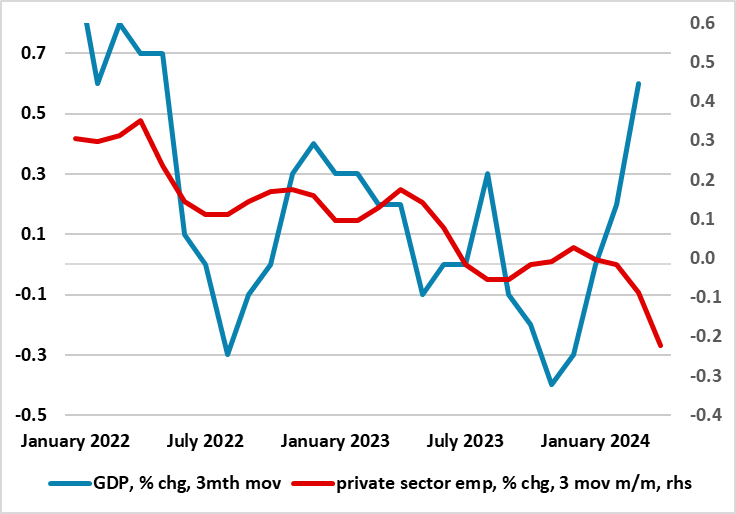

UK GDP Review: Clearer Growth Momentum But Mainly Import Led?

May 10, 2024 6:26 AM UTC

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is much clearer than any expected with GDP growth notably positive. Indeed, coming in more than expected, and despite industrial action, GDP rose by 0.4% m/m in March accentuating the upgraded boun

May 09, 2024

BoE Review: Data Dependent Easing Bias Clearer?

May 9, 2024 12:52 PM UTC

There was little surprise that Bank Rate was kept at 5.25% for the sixth successive MPC meeting, nor that the dissent in favor of an immediate rate cut doubled to two as a result of Dep Gov Ramsden confirming more dovish leanings. The updated projections at least validated the rate path discounted

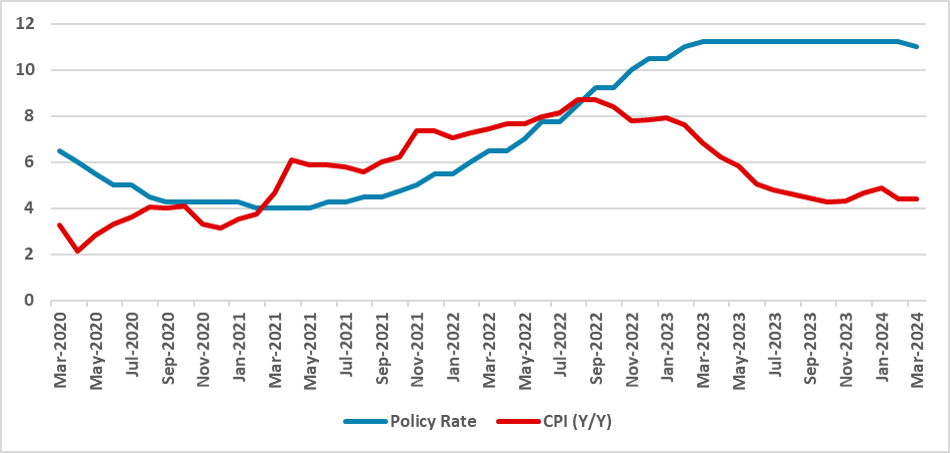

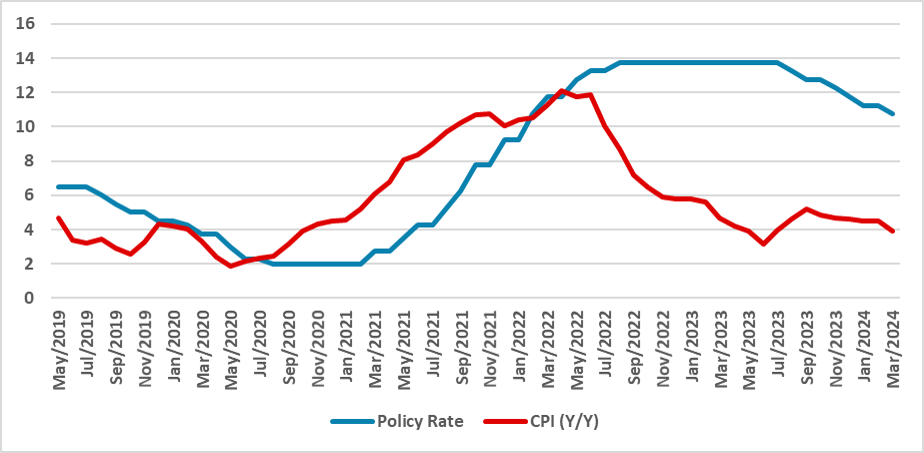

CBRT Lifts End-Year Inflation Forecast to 38%

May 9, 2024 10:22 AM UTC

Bottom Line: Central Bank of Turkiye (CBRT) released the second quarterly inflation report of the year on May 9, and lifted end-year inflation prediction from 36% to 38% citing that the rebalancing process for demand will be more delayed compared to what was projected that in the first inflation rep

May 08, 2024

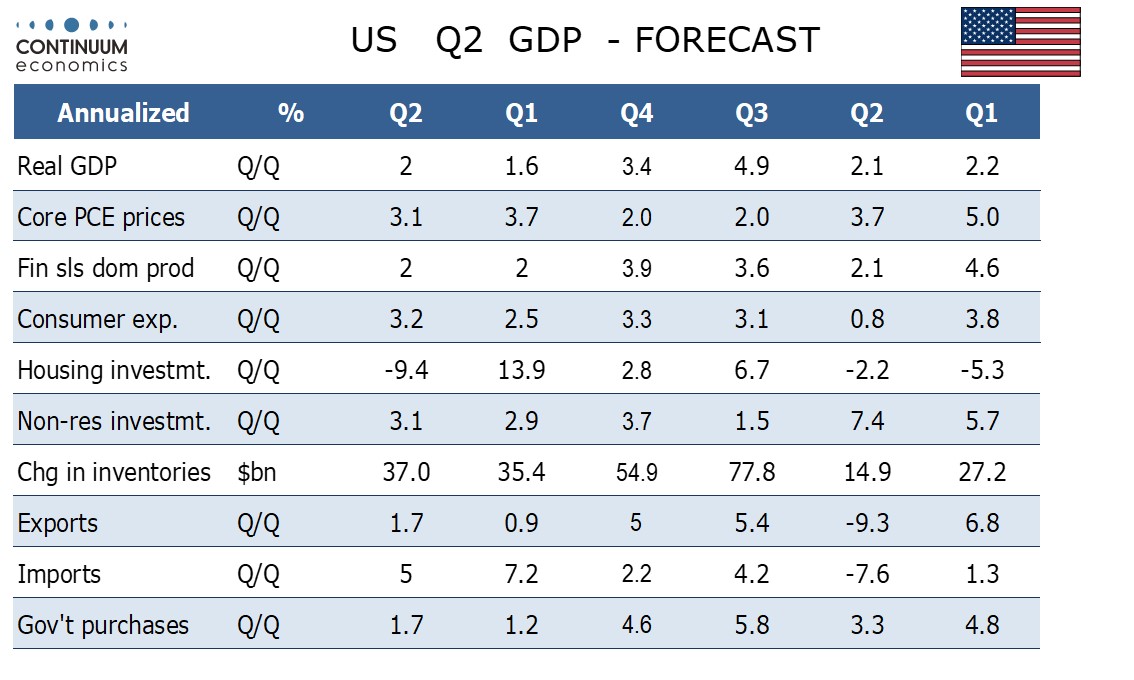

U.S. Q2 GDP to Increase by 2.0% Annualized Before Slowing In the Second Half

May 8, 2024 1:36 PM UTC

In our quarterly outlook on March 22 we looked for Q1 US GDP to rise by 2.4% annualized followed by growth of near 1.0% in the remaining three quarters. While Q1 at 1.6% came in weaker than expected details were constructive for Q2 for which we now expect a 2.0% annualized gain. We continue to expec

Sweden Riksbank Review: Biting the Bullet

May 8, 2024 8:24 AM UTC

It very much seemed to be a question of when, not if, as far as policy easing is concerned for the Riksbank. In this regard, albeit surprising in terms of timing, the Riksbank delivered, cutting its policy rate by 25 bp (to 3.75%), despite clear concerns it has flagged about recent and continued k

May 07, 2024

Indonesia Q4 GDP Review: Robust Start to 2024

May 7, 2024 1:22 PM UTC

Bottom line: Indonesia's Q1 GDP — released on May 6 — saw growth rebound to 5.1% yr/yr from 4.90% yr/yr in Q4 2023. While private consumption continued its ascent, government expenditure emerged as the key driver of Indonesia's growth narrative. Private consumption was supported by festive deman

Banxico Preview: Continuing at 25bps

May 7, 2024 12:43 PM UTC

Banxico will convene on May 9 to decide on the policy rate, having initiated a possible cutting cycle. Despite concerns, the MXN remains stable. The 25bps adjustment aims to maintain tight monetary policy while mitigating inflation. The board may split over this decision, but Banxico is likely to co

May 06, 2024

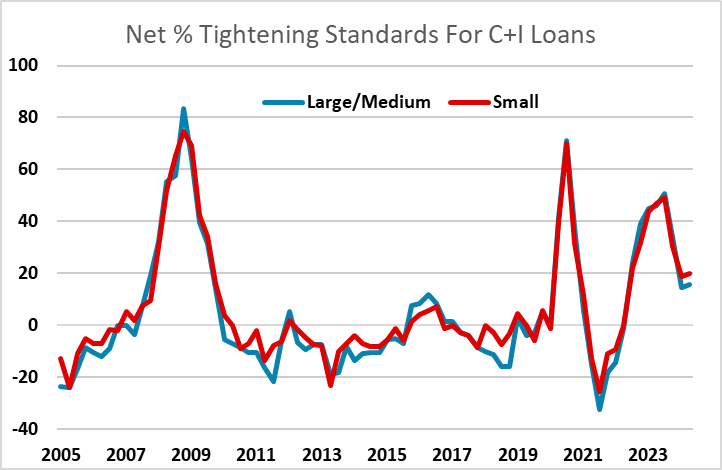

Fed SLOOS on Bank Lending mostly resilient

May 6, 2024 6:27 PM UTC

The Fed’s Q2 Senior Loan Officer Opinion Survey on bank lending practices generally sustains a less negative tone seen in the last survey for Q1, and does not suggest that the Fed need to have any serious concerns about the business investment outlook.

BCB Preview: 25bps or 50bps cut?

May 6, 2024 1:02 PM UTC

The Brazilian Central Bank (BCB) convenes on May 8 to set the policy rate. Previous forward guidance hinted at a 50bps cut in May, but recent statements from BCB President Roberto and some weakness in the BRL have shifted expectations to a 25bps cut. However, we anticipate the BCB maintaining a 50bp

May 03, 2024

Preview: Due May 15 - U.S. April Retail Sales - Pause after a strong month

May 3, 2024 5:00 PM UTC

After a 0.7% increase in March, we expect April retail sales to rise by only 0.3%. Ex autos we expect a 0.2% increase to follow a 1.1% rise in March, while ex autos and gasoline we expect sales to be unchanged after a 1.0% increase in March which was the strongest since October 2022.

U.S. April ISM Services - Weakness may be overstated

May 3, 2024 2:24 PM UTC

April’s ISM services index of 49.4 from 51.4 has fallen below neutral for the first time since December 2022. That dip was explained by bad weather. There is no obvious erratic factor here to explain the weakness, but the details suggests that weakness may be overstated.