View:

May 14, 2024

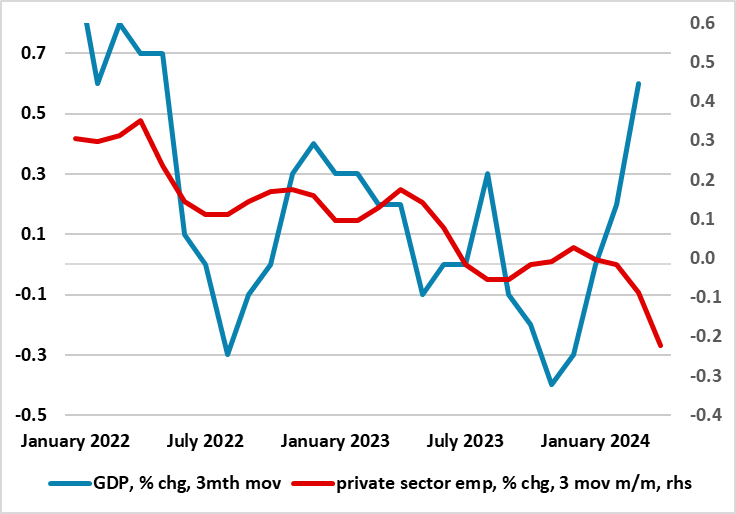

UK Labor Market: Further Signs of Resilient Wage Pressure But Soggier Activity More Notable

May 14, 2024 8:40 AM UTC

As we have underscored repeatedly, the BoE has come to regard the official ONS average earnings data with some suspicion given response rates to the surveys that have fallen towards just 10%. But the BoE will not be able to dismiss the latest earnings data given that alternative (and more author

The Aussie Chapter 3: Risk

May 14, 2024 12:00 AM UTC

In "The Aussie", we will look into the "well-known "correlation among the Aussie and well-known benchmark to give our readers a closer look towards factors that have been affecting the movement of the Australian Dollar. In Chapter 3, we will look into the performance of the Aussie against major equi

May 13, 2024

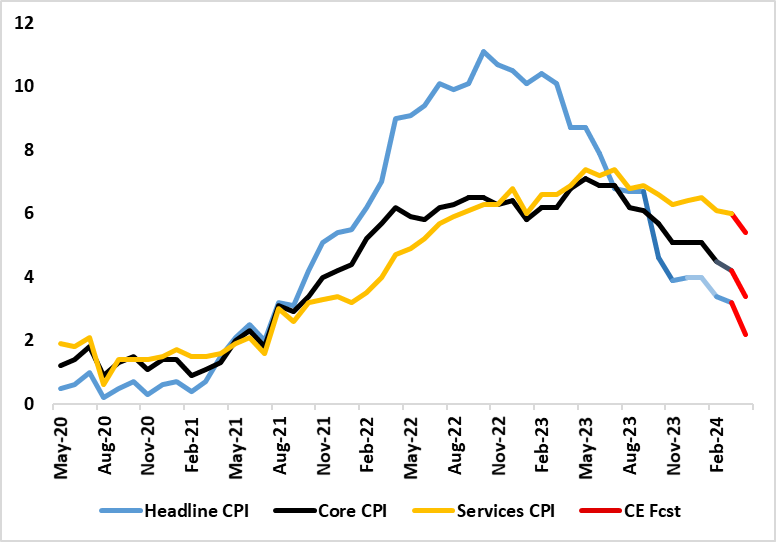

UK CPI Inflation Preview (May 22): Inflation to Fall Further and More Broadly

May 13, 2024 12:10 PM UTC

It is very clear that labor market and CPI data are crucial to BoE thinking about the timing and even existence if any start to an easing cycle. But perhaps the CPI data is the most crucial making the looming April data all the more important for markets as they weigh the chances of an initial rat

China RRR and Rate Cuts

May 13, 2024 7:54 AM UTC

The latest China money supply and lending figures show that private household and business lending is very subdued. More need to be done to boost credit demand as well as credit supply. However, the authorities desires to avoid too much Yuan weakness will likely mean that the next move is a 25bp

May 12, 2024

May 10, 2024

May 09, 2024

CBRT Lifts End-Year Inflation Forecast to 38%

May 9, 2024 10:22 AM UTC

Bottom Line: Central Bank of Turkiye (CBRT) released the second quarterly inflation report of the year on May 9, and lifted end-year inflation prediction from 36% to 38% citing that the rebalancing process for demand will be more delayed compared to what was projected that in the first inflation rep

May 08, 2024

China Equities: A Tactical Play

May 8, 2024 2:20 PM UTC

China equities can see a tactical bounce of 5-10% in the coming months. Cheap valuations and underweight global fund positions means that the scale of pessimism only has to get less bad on the economy and China authorities attitude towards businesses. While we see a tactical opportunity, we do

May 07, 2024

U.S. Fiscal Problems: 2025 More Than 2024

May 7, 2024 1:10 PM UTC

Current real yields in the U.S. government bond market already large reflect the large government deficit trajectory. Even so, H1 2025 could see some extra fiscal tensions that add 30-40bps to 10yr U.S. Treasury yields as the post president election environment will either see a reelected Joe Bide