View:

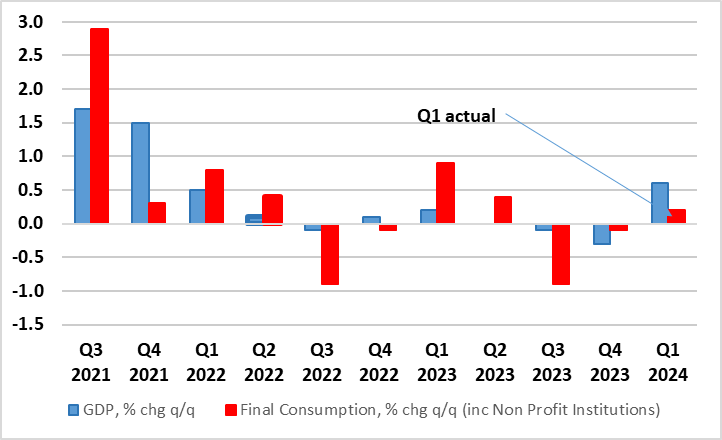

China: Q1 Upside Surprise, but March Disappoints

April 16, 2024 8:33 AM UTC

Q1 GDP upside surprise was driven mainly by public sector investment. With the government still to implement the Yuan 1trn of special sovereign bonds for infrastructure spending, public investment will likely remain a key driving force. However, the breakdown of the March data show that retail s

Ukraine War Update: Major Russian Offensive is Expected This Summer Despite U.S. Military Aid

May 8, 2024 12:06 PM UTC

Bottom Line: The offensives at the front lines started to pick up steam after March/April as the Russian forces plan for their larger summer 2024 offensive operation, aiming to seize more territory before the U.S. presidential elections in November. In the meantime, U.S. approved a $61 billion warti

EMFX: Diverging On Domestic Forces Not Less Fed Easing Hopes

May 3, 2024 10:45 AM UTC

While U.S. economic developments, plus Fed policy prospects, will be important in terms of EM currency developments, domestic politics and fundamentals will also be decisive. These can keep the South Africa Rand volatile in the remainder of 2024, given the risk of a coalition government and African

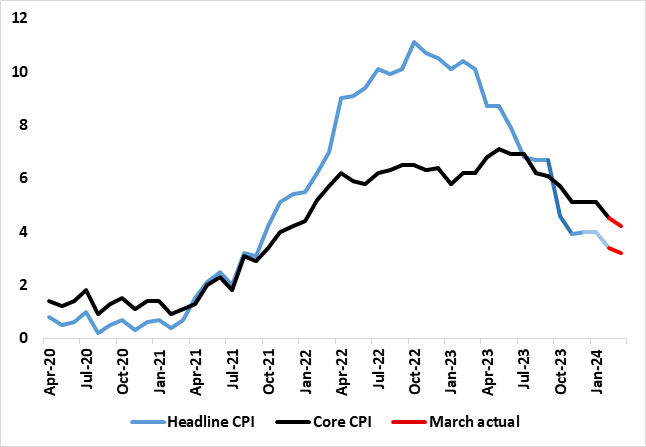

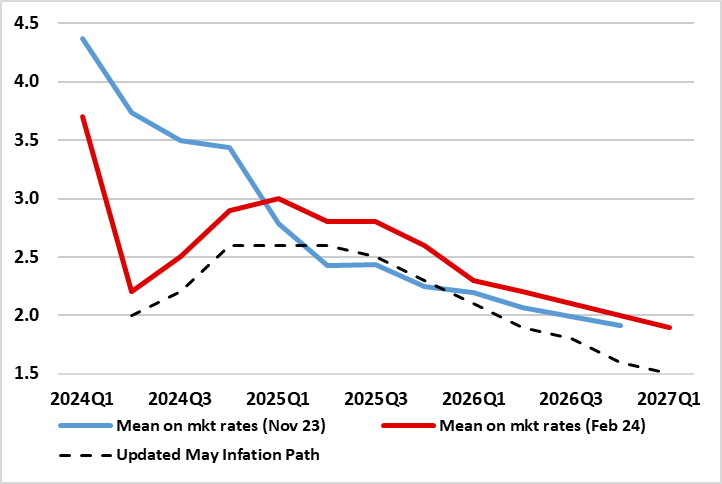

UK CPI Inflation Review: Inflation Fall Further, But Services Momentum Still Evident

April 17, 2024 6:52 AM UTC

UK headline and core inflation have been on a clear downward trajectory in the last few months, the former having peaked above 10% in February last year and the latter at 7.1% In May. After a pause in the preceding three months, this downtrend seemingly resumed in the February CPI numbers and clearl

U.S. Fiscal Problems: 2025 More Than 2024

May 7, 2024 1:10 PM UTC

Current real yields in the U.S. government bond market already large reflect the large government deficit trajectory. Even so, H1 2025 could see some extra fiscal tensions that add 30-40bps to 10yr U.S. Treasury yields as the post president election environment will either see a reelected Joe Bide

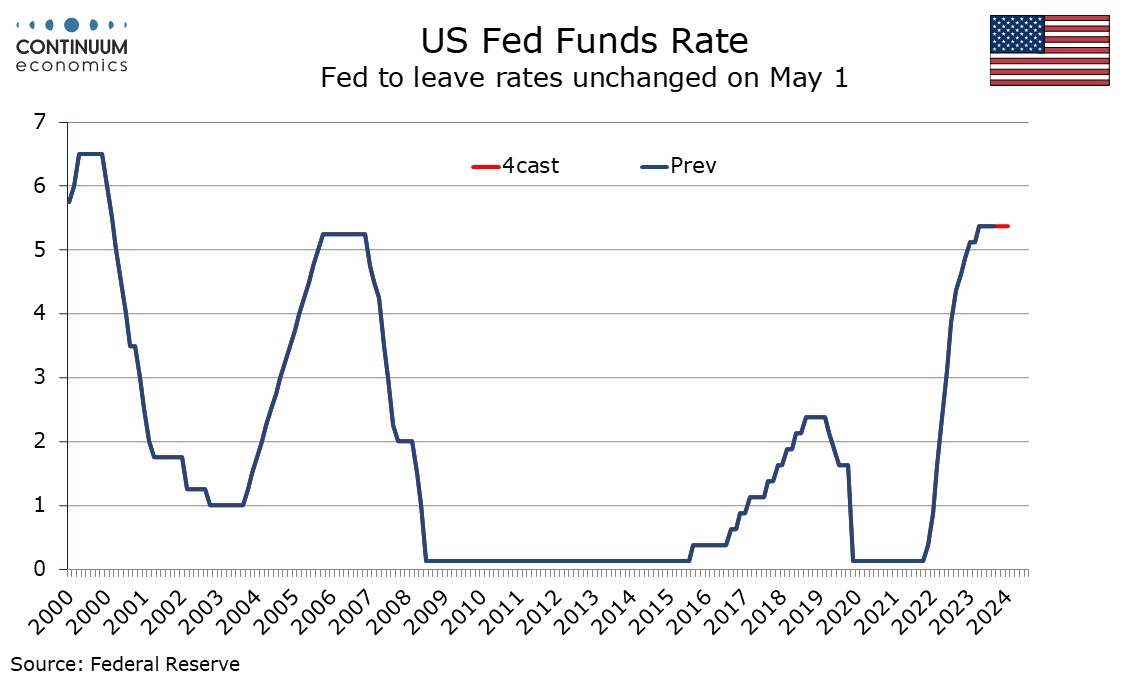

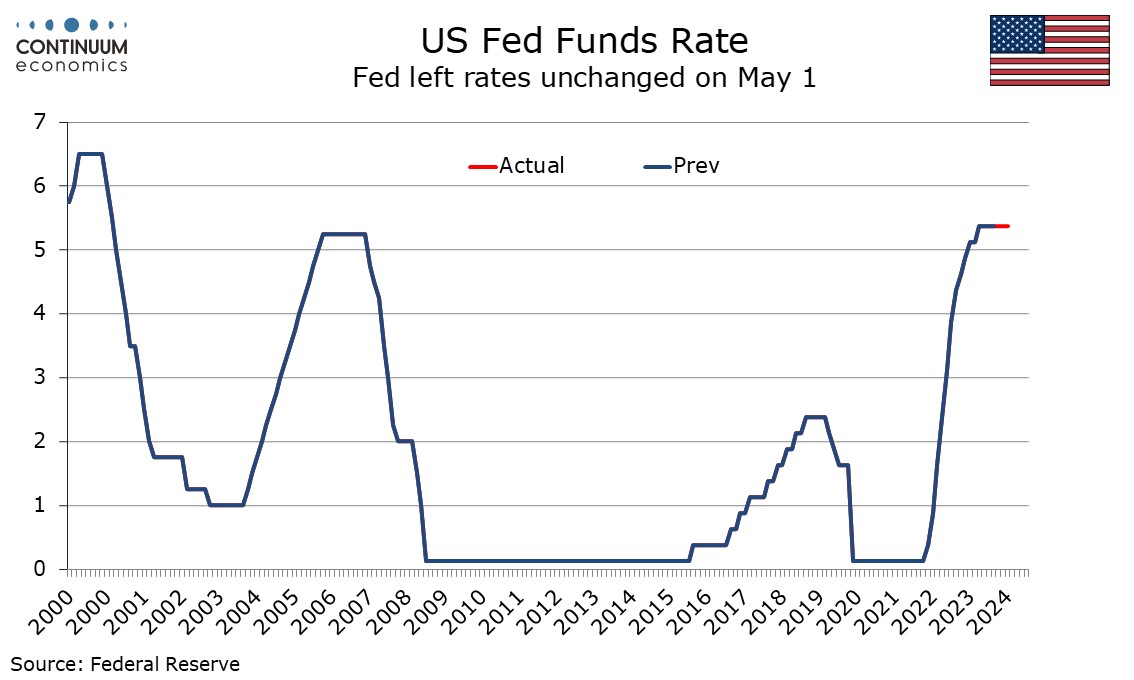

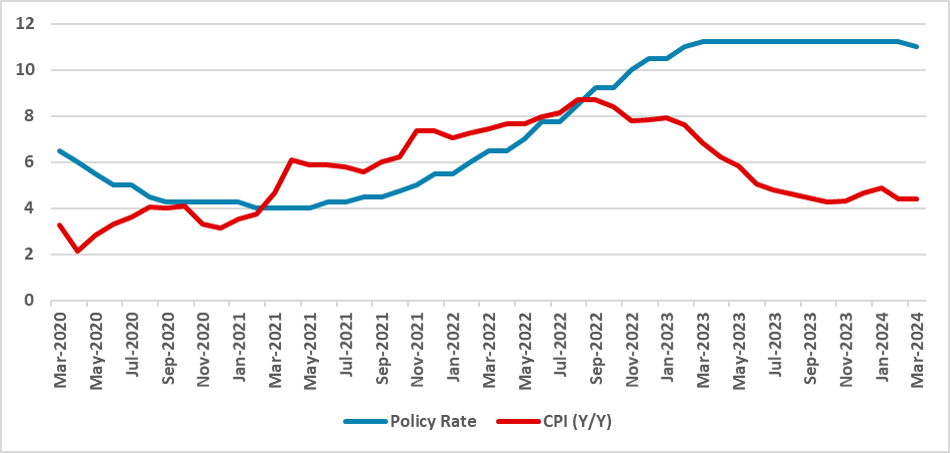

FOMC Preview For May 1: Signaling Concern on Inflation, Tapering Quantitative Tightening

April 25, 2024 7:04 PM UTC

Bottom Line: The FOMC meets on May 1 and rates look sure to remain at the current 5.25%-5.50% target range. The statement is likely to see some adjustments to reflect recent disappointment on inflation while repeating that more confidence on inflation moving towards target is needed before easing. I

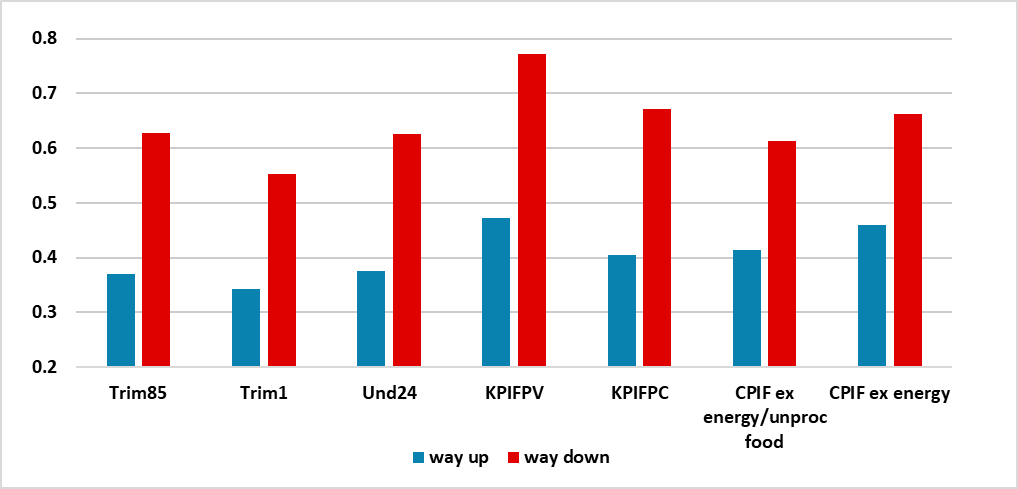

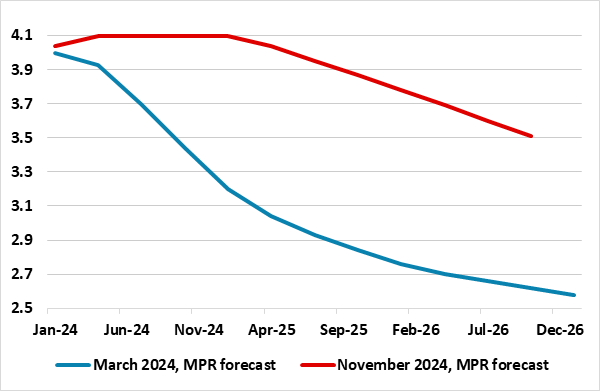

Sweden Riksbank Review: Biting the Bullet

May 8, 2024 8:24 AM UTC

It very much seemed to be a question of when, not if, as far as policy easing is concerned for the Riksbank. In this regard, albeit surprising in terms of timing, the Riksbank delivered, cutting its policy rate by 25 bp (to 3.75%), despite clear concerns it has flagged about recent and continued k

Sweden Riksbank Preview (May 8): When, Not If?

May 1, 2024 8:09 AM UTC

It seems to be a question of when, not if as far as policy easing is concerned. Even at it previous policy assessment in February it was clear(er) that the Riksbank accepted that it could and should make its policy stance less contractionary, at least in conventional terms. But its last decision

China Equities: A Tactical Play

May 8, 2024 2:20 PM UTC

China equities can see a tactical bounce of 5-10% in the coming months. Cheap valuations and underweight global fund positions means that the scale of pessimism only has to get less bad on the economy and China authorities attitude towards businesses. While we see a tactical opportunity, we do

FOMC Still Waiting For Data to Justify Easing

May 1, 2024 7:58 PM UTC

The May 1 FOMC statement, and Chairman Jerome Powell’s press conference, while noting recent inflation disappointment, did not deliver a strong pivot in tone. The Fed is still waiting for data to allow easing to take place, but still expects inflation to slow, and looks ready to respond once data

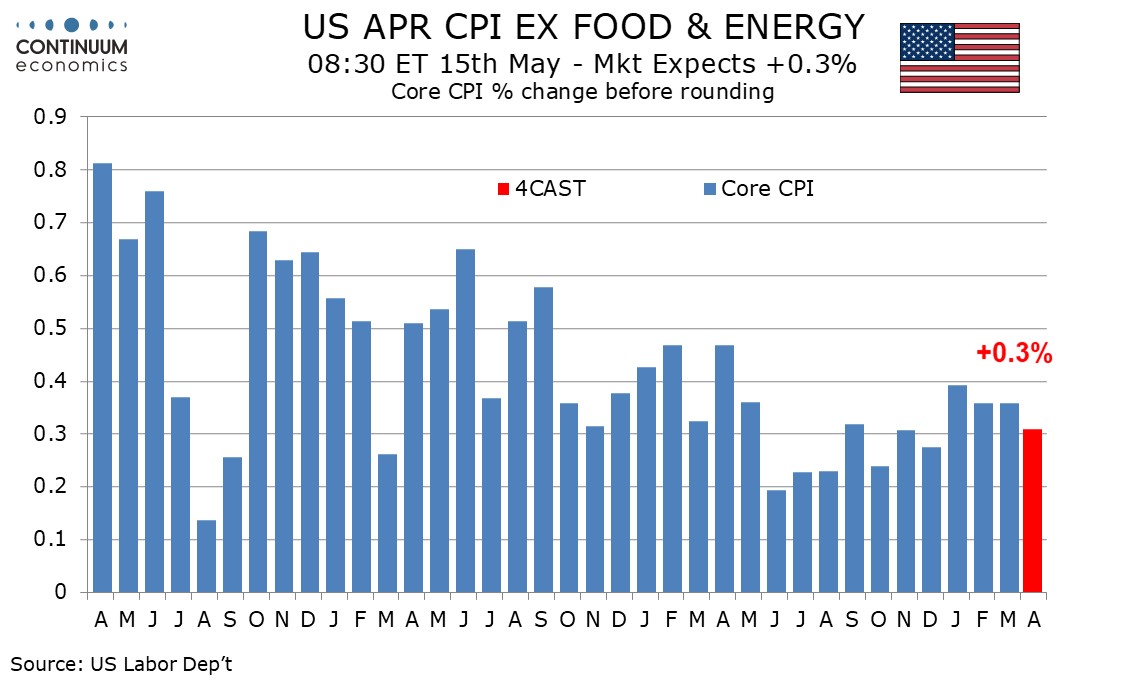

Preview: Due May 15 - U.S. April CPI - Core rate not quite as strong as the preceding three months

April 30, 2024 5:15 PM UTC

We expect April CPI to rise by 0.4% overall for a third straight month but with the ex food and energy pace slowing to 0.3% after three straight months at 0.4%. We expect the strong start to the year to fade as the year progresses, though inflationary pressures will still look quite significant in A

China: Depreciation Rather Than Devaluation

April 29, 2024 1:00 PM UTC

We feel that a devaluation of the Yuan is unlikely in 2024, both to avoid potentially politically destabilizing capital outflows but also to avoid upsetting the next U.S. president. Policy is geared more towards controlled depreciation to help competiveness but reduce other risks. The Yuan has a

Markets: Fed Rather Than Middle East Worries

April 17, 2024 12:34 PM UTC

Global markets are being driven by a scale back in Fed easing expectations and we see a 5-10% U.S. equity market correction being underway. However, with the market now only discounting one 25bps Fed cut in 2024, any downside surprises on U.S. growth or better controlled monthly inflation numbers

UK GDP Review: Clearer Growth Momentum But Mainly Import Led?

May 10, 2024 6:26 AM UTC

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is much clearer than any expected with GDP growth notably positive. Indeed, coming in more than expected, and despite industrial action, GDP rose by 0.4% m/m in March accentuating the upgraded boun

BoE Review: Data Dependent Easing Bias Clearer?

May 9, 2024 12:52 PM UTC

There was little surprise that Bank Rate was kept at 5.25% for the sixth successive MPC meeting, nor that the dissent in favor of an immediate rate cut doubled to two as a result of Dep Gov Ramsden confirming more dovish leanings. The updated projections at least validated the rate path discounted

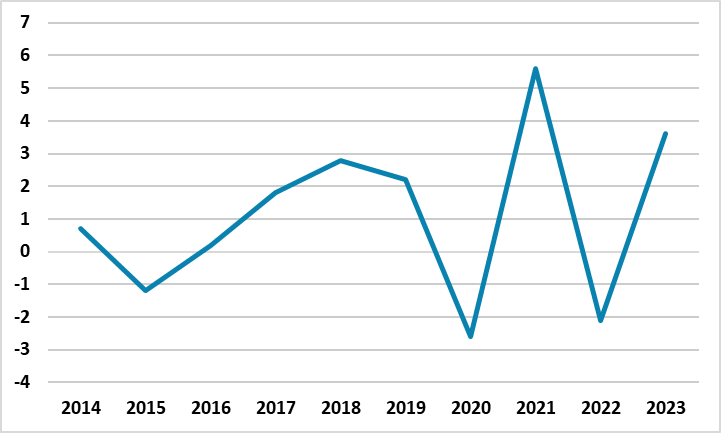

Russian Economy Expands by 4.2% YoY in March, and 5.4% in Q1

May 3, 2024 2:14 PM UTC

Bottom Line: According to the figures announced by the Russian Ministry of Economic Development, Russia's GDP grew by 4.2% YoY in March owing to strong fiscal stimulus, high military spending, invigorating consumer demand and investments. We now foresee Russian economy will expand by 2.6% in 2024

CBRT Lifts End-Year Inflation Forecast to 38%

May 9, 2024 10:22 AM UTC

Bottom Line: Central Bank of Turkiye (CBRT) released the second quarterly inflation report of the year on May 9, and lifted end-year inflation prediction from 36% to 38% citing that the rebalancing process for demand will be more delayed compared to what was projected that in the first inflation rep

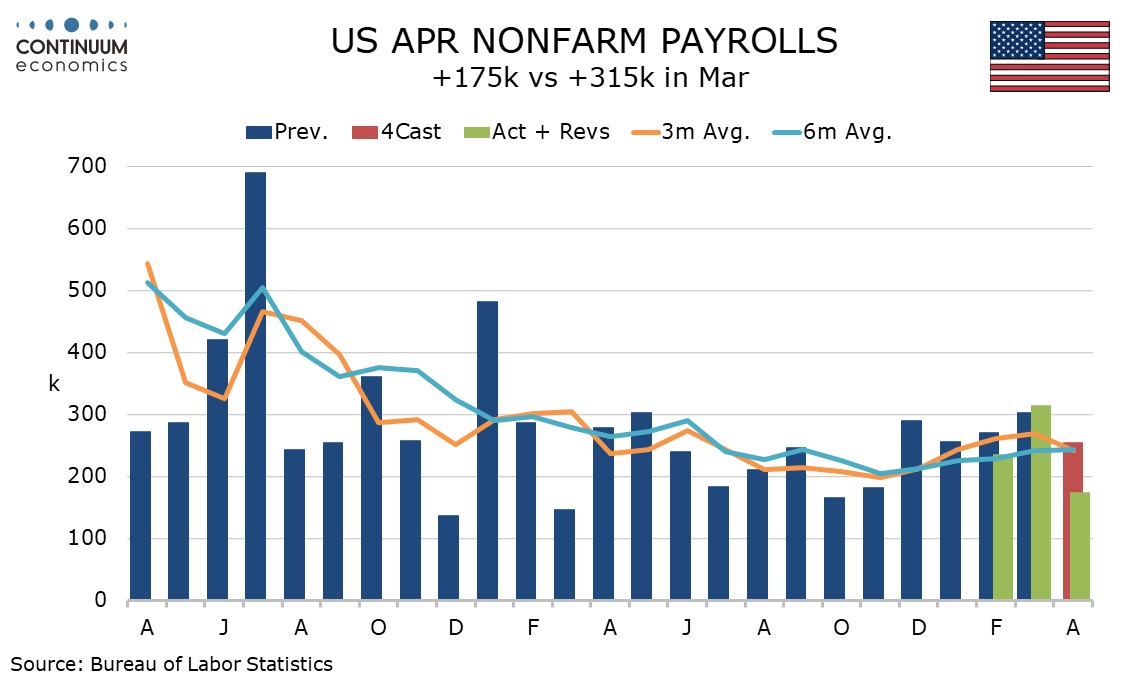

U.S. April Employment - On the weak side in all key details, following strength in March

May 3, 2024 1:18 PM UTC

April’s non-farm payroll is on the low side of consensus across the board, with a 175k increase (though the 167k private sector rise is only modestly below consensus), with a 0.2% rise in average hourly earnings, a fall in the workweek and a rise in unemployment to 3.9% from 3.8%. The data should

China Politburo: Help for Housing, But No Game changers

May 2, 2024 10:50 AM UTC

Politburo statement in late April suggests extra support for residential property. However, we see this as being incremental rather than any game changers and we still see residential investment remaining a negative drag on 2024 GDP growth.

U.S. Q1 Employment Cost Index - Acceleration will add to Fed concerns on inflation

April 30, 2024 12:46 PM UTC

The Q1 Employment Cost Index with a 1.2% increase is stronger than expected and like Q1 inflation data, breaks a trend of gradual slowing seen in late 2023 to produce a renewed acceleration, rising by its most since Q1 2023.

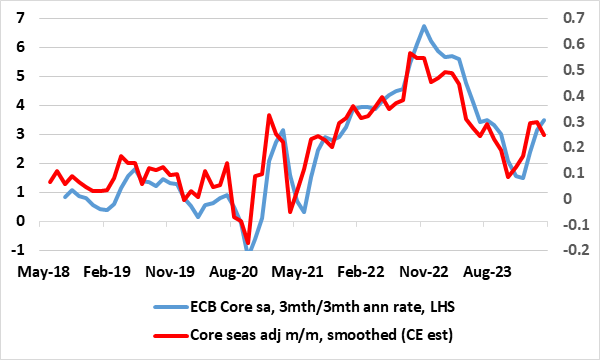

Eurozone Data Review: Less Weak But Soft Domestic Demand Taking Less Toll on Core Inflation?

April 30, 2024 9:29 AM UTC

According to revised official national accounts data, the EZ economy was in recession in H2 last year, albeit modestly so and against a backdrop of marked, if not increasing, national growth divergences. This geographical variation continued into Q1 (Figure 1) where the flash GDP reading exceeded ex

Headwinds To Long-term Global Growth

April 26, 2024 9:30 AM UTC

Bottom line: While much focus is on the cyclical economic position to determine 2024 monetary policy prospects, the 2025-28 structural growth trajectory differs to the pre 2020 GDP trajectory for major economies. While global fragmentation has a role to play, aging populations are already having a

The Pulse of the Nation: Insights into India's 2024 Election

April 22, 2024 7:54 AM UTC

As India braces itself for the upcoming elections, the political landscape is rife with anticipation, strategy, and uncertainty. With the ruling Bharatiya Janata Party (BJP) seeking to consolidate its power and a diverse coalition of opposition forces vying for a chance to unseat them, the stage is

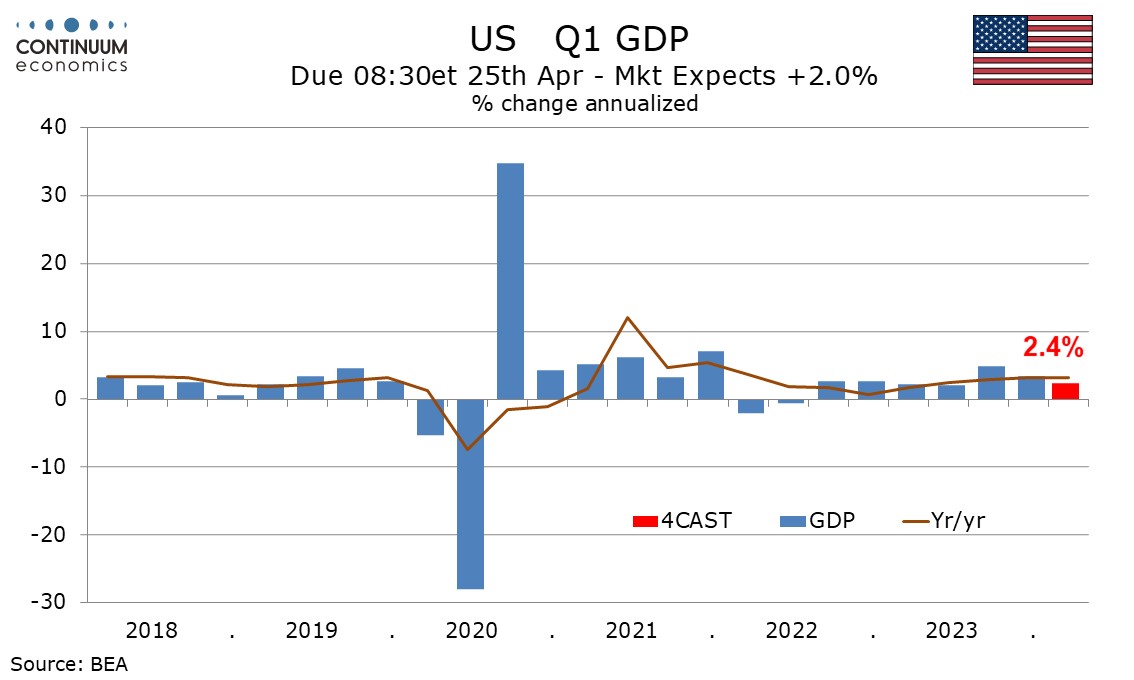

Preview: Due April 25 - U.S. Q1 GDP - Slower but Still Healthy With Stronger Core PCE Prices

April 17, 2024 3:06 PM UTC

We expect a 2.4% annualized increase in Q1 GDP, significantly slower than the second half of 2023 but slightly stronger than the first half and still a heathy pace of growth. We expect a pick up in the core PCE price index to 3.4% annualized after two straight quarters at 2.0%.

China RRR and Rate Cuts

May 13, 2024 7:54 AM UTC

The latest China money supply and lending figures show that private household and business lending is very subdued. More need to be done to boost credit demand as well as credit supply. However, the authorities desires to avoid too much Yuan weakness will likely mean that the next move is a 25bp

Banxico Preview: Continuing at 25bps

May 7, 2024 12:43 PM UTC

Banxico will convene on May 9 to decide on the policy rate, having initiated a possible cutting cycle. Despite concerns, the MXN remains stable. The 25bps adjustment aims to maintain tight monetary policy while mitigating inflation. The board may split over this decision, but Banxico is likely to co