Bank of Canada

View:

May 09, 2024

April 30, 2024

Canada February GDP - Q1 looking less positive than previously projected

April 30, 2024 1:20 PM UTC

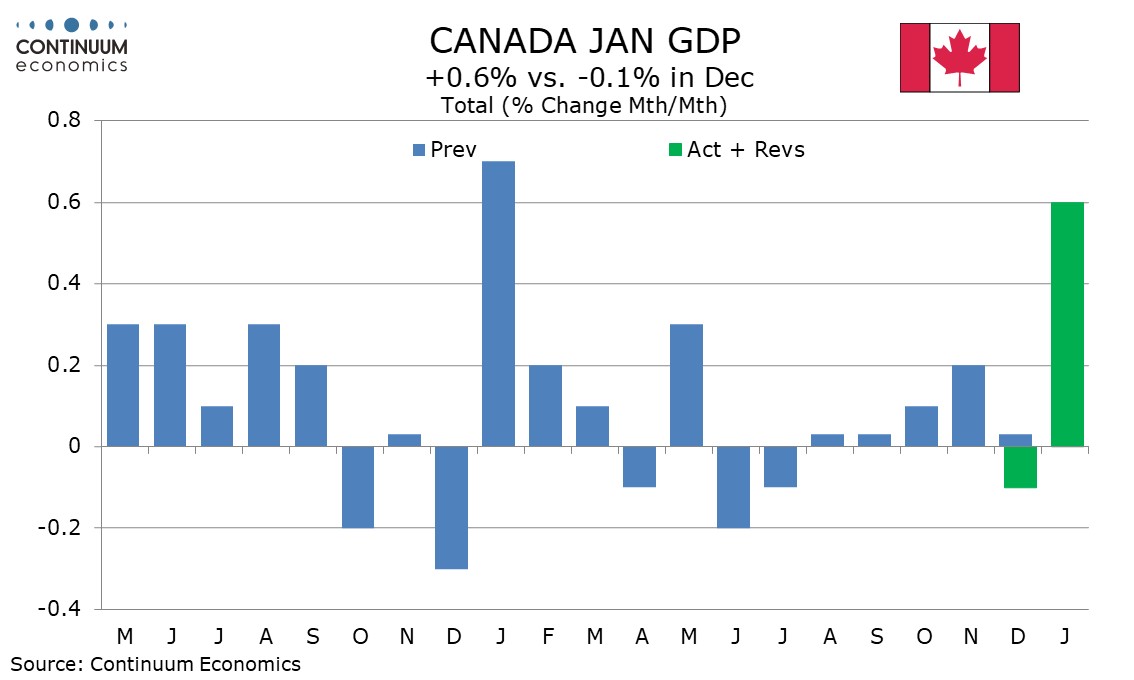

February Canadian GDP saw a second straight rise, but at 0.2% was below the 0.4% projected with January’s data and January was revised down to a 0.5% increase from 0.6%. The advance estimate for March is unchanged, which would leave a 0.6% rise (2.5% annualized) in Q1.

April 24, 2024

Bank of Canada Minutes Look to Gradual Easing, Divided on When to Start

April 24, 2024 6:44 PM UTC

Bank of Canada minutes from the April 10 meeting confirm a greater confidence on inflation falling, though there is disagreement within the Governing Council over when policy easing will become appropriate. There was agreement that easing would probably be gradual given the risks to the outlook and

April 16, 2024

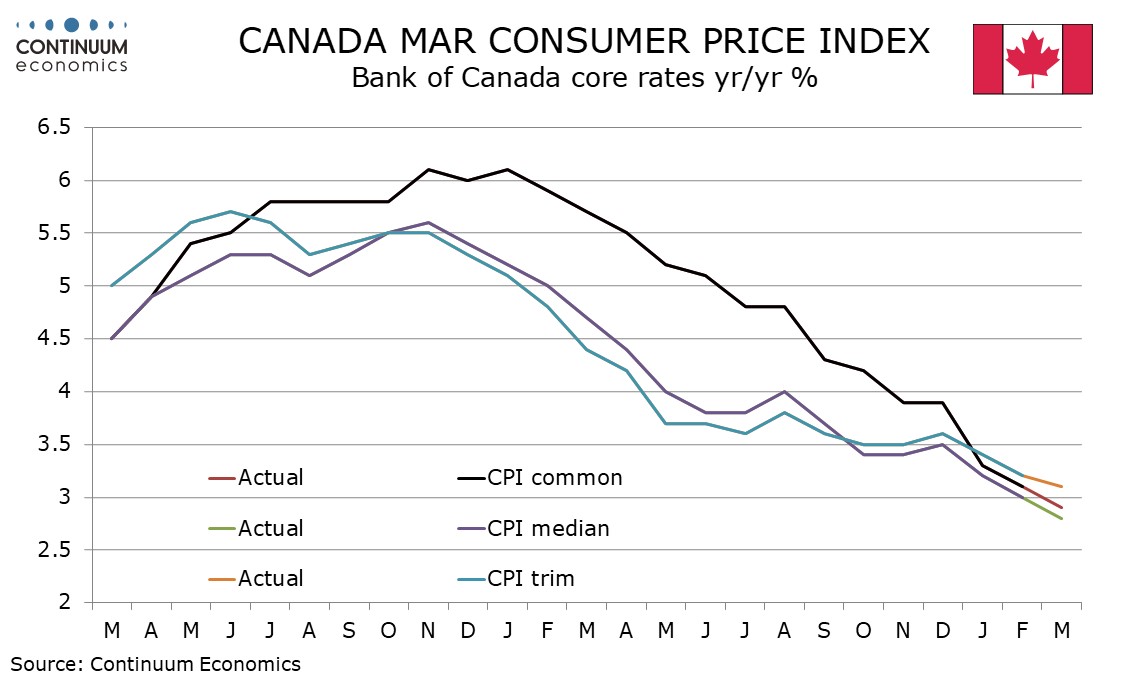

Canada March CPI a little firmer after two soft months, but BoC core rates continue to fall

April 16, 2024 12:53 PM UTC

March’s Canadian CPI has seen an as expected increase to 2.9% yr/yr from February’s unexpectedly softer 2.8%. On the month the seasonally adjusted data is a little firmer after two soft months but the Bank of Canada’s core rates continue to fall.

April 10, 2024

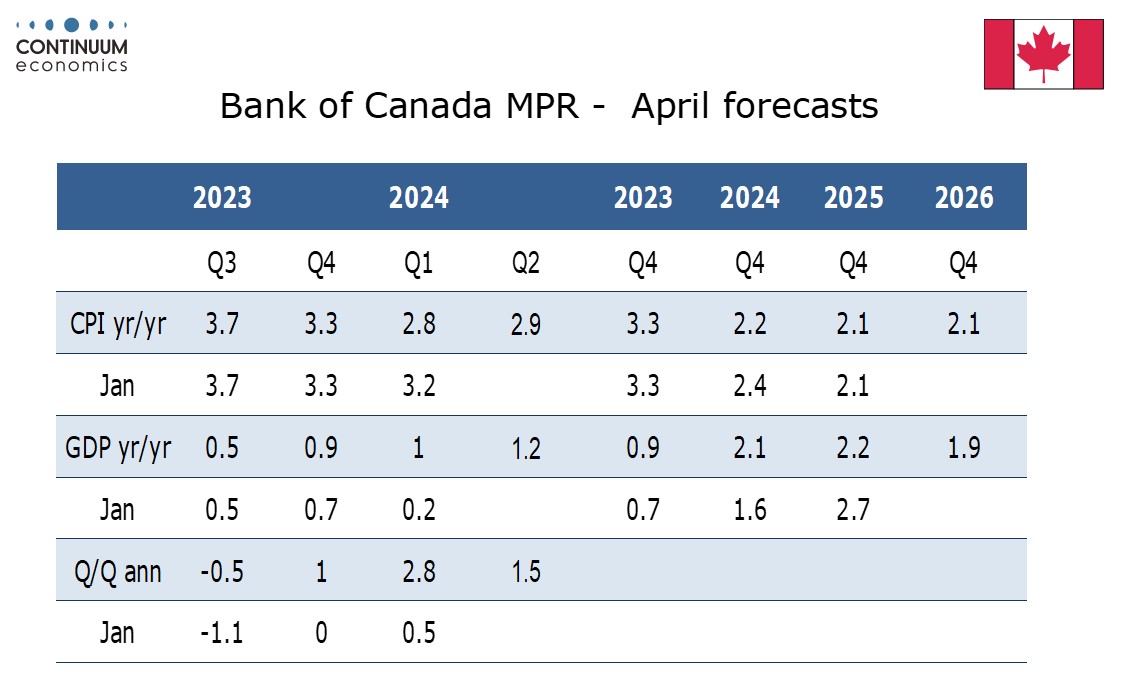

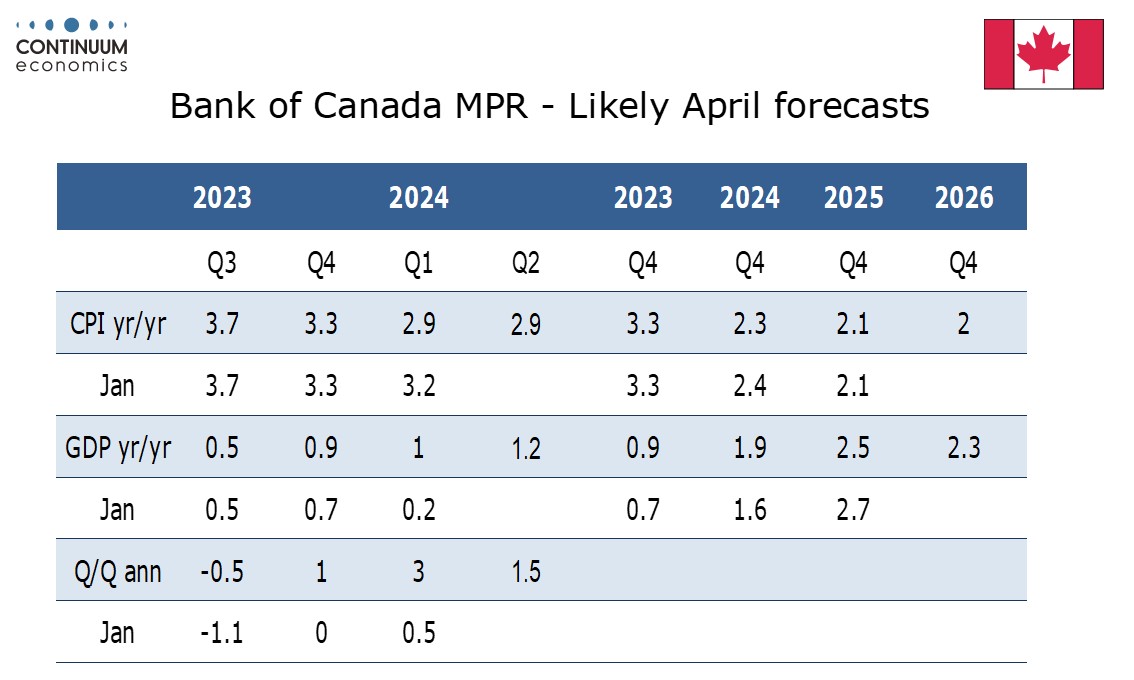

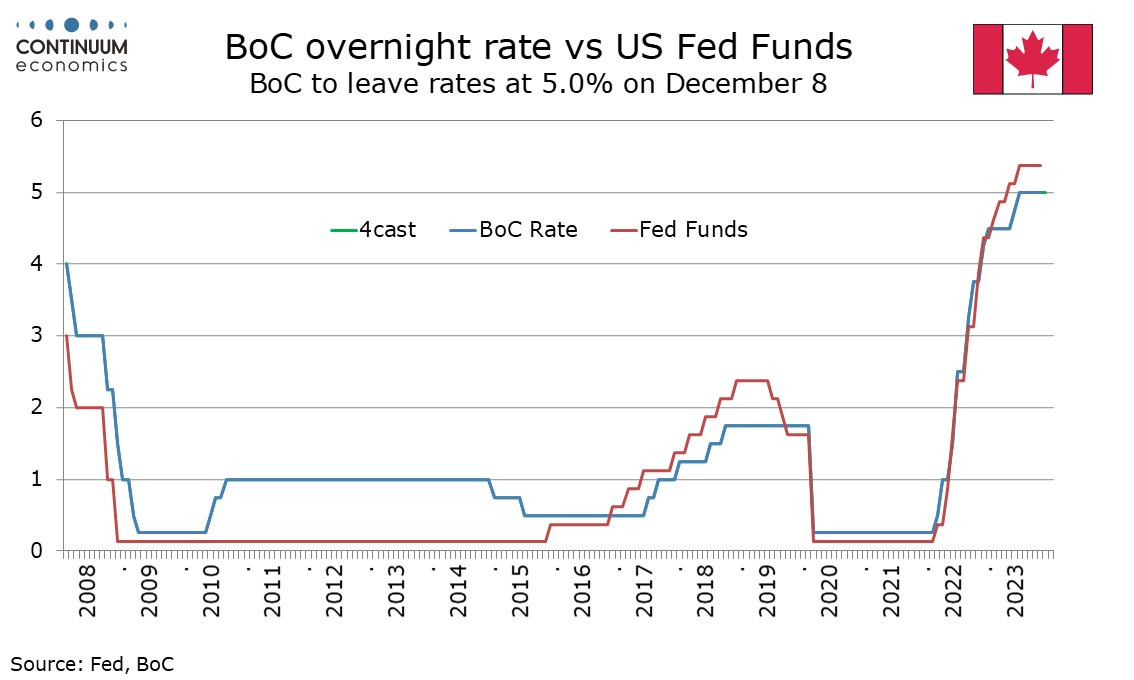

Bank of Canada Sees Progress in Reducing Inflation, June Easing Possible

April 10, 2024 3:37 PM UTC

The Bank of Canada made no policy changes with rates left at 5.0% and Quantitative Tightening continuing as expected. However the tone of the statement is significantly more optimistic on inflation, focusing more on this than recent signs of stronger activity. The BoC still needs to see progress on

April 02, 2024

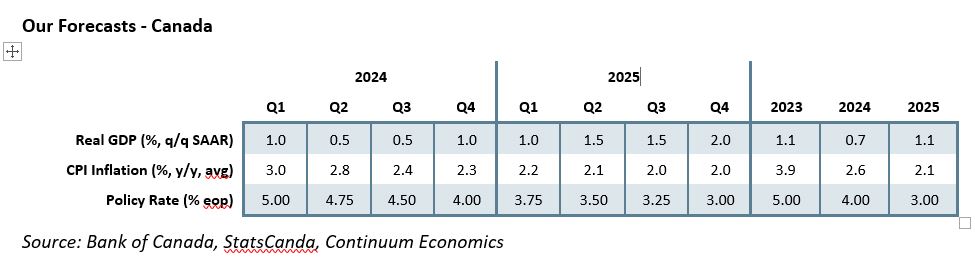

Bank of Canada to Leave Rates Unchanged on April 10, Noting Stronger GDP and Slower CPI

April 2, 2024 5:45 PM UTC

The Bank of Canada meets on April 10 and no change in rates from the current 5.0% is likely. The BoC is likely to revise near term forecasts for GDP higher and CPI lower, and leave its options open for easing at future meetings, dependent on incoming data, without giving any clear signals on timing.

April 01, 2024

Canada - BoC Q1 Business Outlook Survey shows some easing in inflation expectations

April 1, 2024 2:53 PM UTC

The Bank of Canada’s Q1 business outlook survey shows some easing of inflation expectations while being mostly subdued on the economic picture. The BoC looks unlikely to ease on April 10 with Q1 GDP looking set to exceed expectations, but this survey helps to maintain hope that by June enough prog

March 28, 2024

Canada January GDP - Q1 looking much stronger than BoC had expected

March 28, 2024 1:31 PM UTC

Not only did January Canadian GDP with a 0.6% rise exceed the preliminary 0.4% estimate, in data assisted by the end of a strike, the advance estimate for February is strong too with a rise of 0.4%. If that proves correct even an unchanged March would leave Q1 up by 3.5% annualized, well above the B

March 26, 2024

March 21, 2024

March 19, 2024

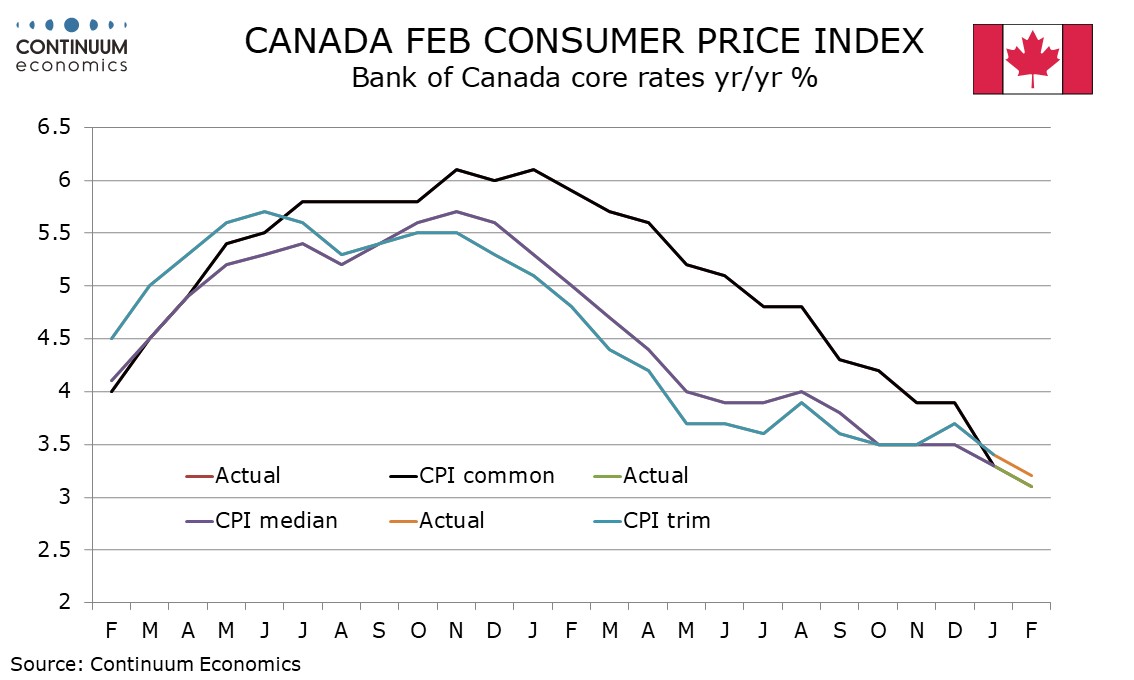

Canada February CPI slows, BoC's Gravelle to speak on QT on Thursday

March 19, 2024 1:23 PM UTC

February’s Canadian CPI has seen an unexpected fall to 2.8% yr/yr from 2.9% in January and 3.4% in December, putting the series at its lowest since March 2021. While the Bank of Canada cannot claim victory yet, the data will provide encouragement that inflationary pressures are now fading. A spe

March 06, 2024

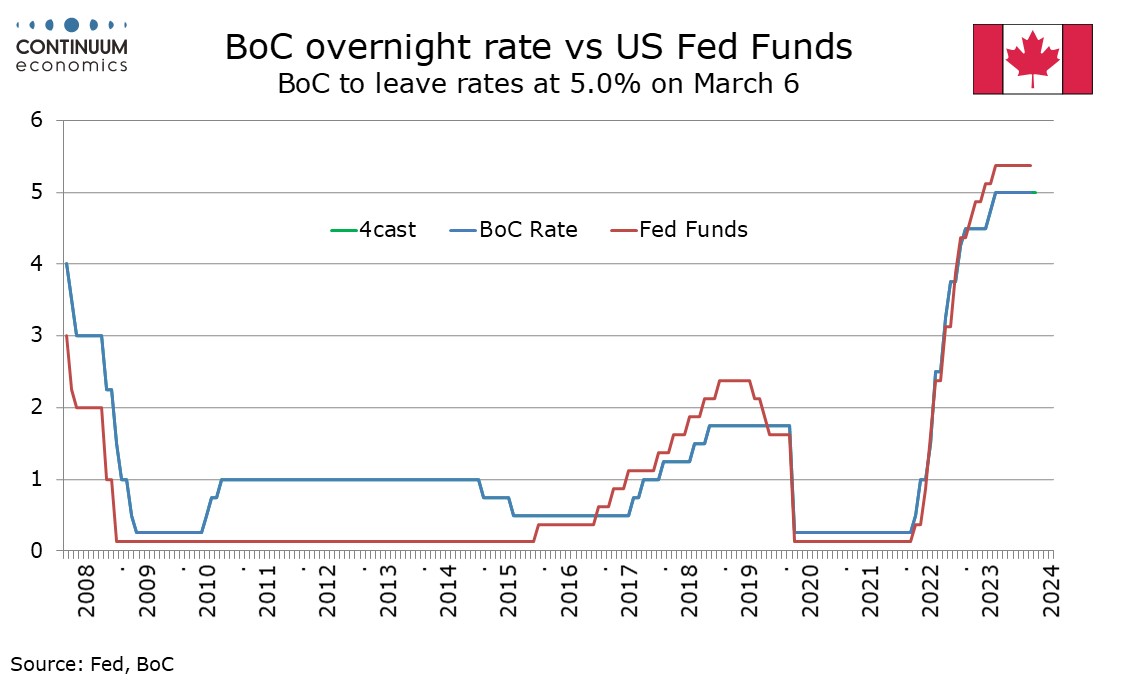

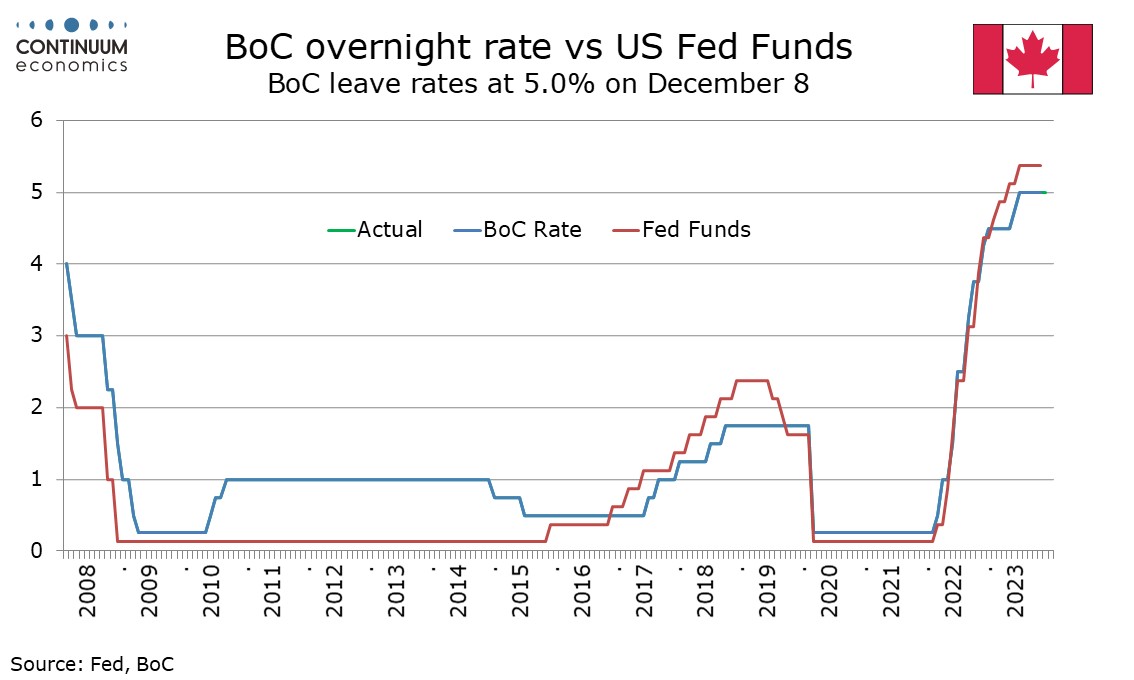

Bank of Canada Keeps Markets Waiting

March 6, 2024 6:49 PM UTC

The Bank of Canada left both rates (at 5.0%) and its forward guidance unchanged in its latest statement. A rate cut at the next meeting in April now looks unlikely, and while we continue to project a move in June it is now a close call between June and July for when the BoC starts to cut rates.

February 29, 2024

Bank of Canada to Leave Rates Unchanged on March 6, With a Cautious Statement

February 29, 2024 6:41 PM UTC

The Bank of Canada meets on March 6 and while any fine tuning to the statement is more likely to be dovish than hawkish, we doubt that views have changed much at the BoC since its last meeting on January 24. We expect rates to be left unchanged at 5.0% with few hints that easing is close to be given

February 07, 2024

Bank of Canada Minutes Detail Inflationary Concerns

February 7, 2024 7:39 PM UTC

The Bank of Canada’s minutes from January 24 show significant concern about the persistence of inflation, despite seeing the economy as having moved into excess supply due to slowing demand. This leaves the BoC unsure about when to cut rates, though further increases now look unlikely.

February 06, 2024

January 31, 2024

Canada November GDP - Q4 looking stronger than BoC projected

January 31, 2024 2:06 PM UTC

November Canadian GDP with a rise of 0.2% saw momentum pick up after there straight flat outcomes which flowed two straight negatives. The preliminary estimate for December is stronger still at 0.3%, which suggests Q4 will come in stronger than a flat forecast from the BoC.

January 30, 2024

Preview: Due January 31 - Canada November GDP - Q4 may exceed BoC forecast

January 30, 2024 1:26 PM UTC

We expect Canadian GDP to increase by 0.2% in November, which would be slightly stronger than a preliminary 0.1% estimate made with October’s report and the strongest month since May. We expect December’s preliminary estimate will be marginally positive too, suggesting Q4 GDP will beat not only

January 24, 2024

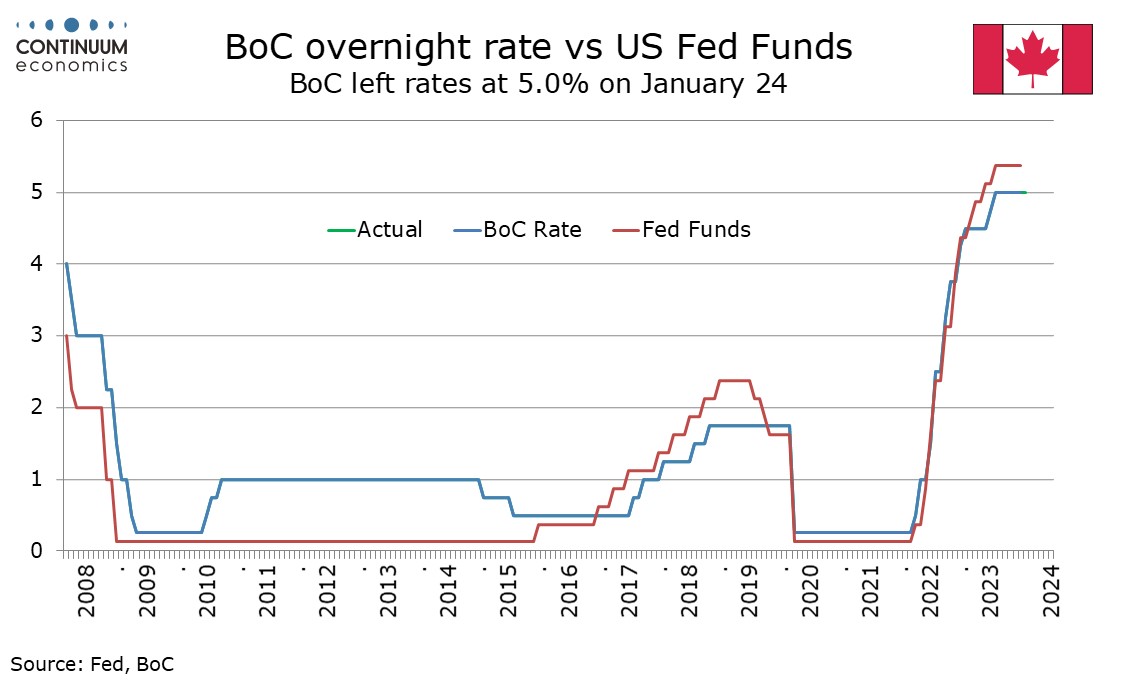

Bank of Canada Drops Tightening Bias

January 24, 2024 5:15 PM UTC

The Bank of Canada left rates at 5.0% as expected though the statement took a clearly more dovish tone, dropping a tightening bias though still expressing concern over persistently high inflation. Easing does not appear imminent but we now expect it to start in Q2 rather than Q3.

January 16, 2024

Bank of Canada Unlikely to Hint at Easing on January 24

January 16, 2024 7:25 PM UTC

The Bank of Canada meets on January 24 and rates look highly likely to remain unchanged at 5.0%. The statement is likely to see a similar tone to that on December 6 which no longer saw the economy as in excess demand but remained willing to raise the policy rate further if needed.

December 19, 2023

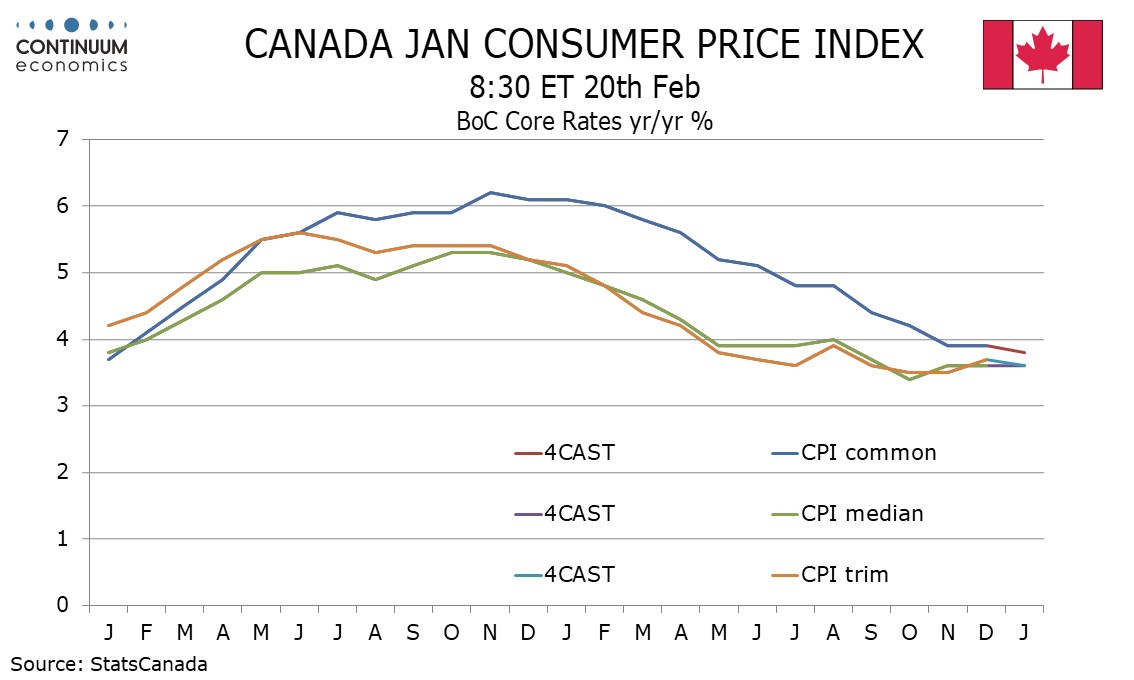

Canada November CPI - Worrying underlying resilience

December 19, 2023 2:34 PM UTC

The BoC’s core rates show CPI-median unchanged at 3.4% yr/yr and CPI-trim unchanged at 3.5%, both above consensus though CPI-common did slip to 3.9% from 4.2%. The average of the three at 3.6% is the lowest since December 2021 but still well above the BoC’s 2.0% target.

On the month CPI rose by 0

December 15, 2023

December 06, 2023

Bank of Canada Tightening Bias Persists but is Reduced

December 6, 2023 3:44 PM UTC

The BoC states that economic growth stalled in the middle quarters of 2023, which gives roughly equal weight to a negative Q3 and an upwardly revised positive in Q2, appropriately with momentum stabilizing in late Q3 to suggest a broadly flat picture. However the BoC concludes that the economy is no

December 01, 2023

Bank of Canada to Leave Rates Unchanged With Mild Tightening Bias

December 1, 2023 2:46 PM UTC

The October 25 statement saw clearer signs that monetary policy is moderating spending and relieving price pressures, and with Q3 GDP showing an unexpected decline of 1.1% annualized, well below an October BoC forecast for a 0.8% increase, that assessment is likely to persist. However the Q3 decline

November 16, 2023

Long-term Forecasts to download in Excel

November 16, 2023 10:38 AM UTC

We present our annual forecasts that go out to 2030 for GDP Growth, Inflation, and Monetary Policy and to 2028 for Exchange Rates. The file contains five sheets: a Country Coverage summary page and a sheet for each of the four indicators.

The forecasts are consistent with the Long-term Forecasts: DM

Long-term Forecasts: DM Policy Easing

November 16, 2023 8:44 AM UTC

The Continuum Economics research team has spent much of the last month researching, reviewing and debating our long-term GDP, CPI inflation and central bank policy rate forecasts for 2025-30. Alongside a reassessment of long-term factors such as productivity and demographics, we have examined the la

November 08, 2023

Bank of Canada Agreed to Hold on October 25, but Split on Future

November 8, 2023 7:12 PM UTC

The views outlined above may look similar to what we will hear from FOMC minutes from their November 1 meeting on November 21, despite the fact that momentum in the Canadian economy has stalled to near zero while US GDP saw a strong advance in Q3. There may even be more at the BoC expecting further

October 25, 2023

Bank of Canada Forecast Fine Tuned, Easing Later but Faster in 2024

October 25, 2023 5:06 PM UTC

The BoC’s updated view

The BoC stated that there is growing evidence that past interest rate increases are dampening economic activity and relieving price pressures. There can be little doubt over the first conclusion given recent GDP data, but that the BoC felt able to make the second conclusion i

October 17, 2023

Bank of Canada to Hold Rates on October 25, Won’t Signal Rates Have Peaked

October 17, 2023 4:34 PM UTC

A quarterly Monetary Policy Report is due at the meeting. This will confirm that Q3 GDP at -0.2% annualized significantly underperformed a 1.5% forecast made with July’s MPR, and that Q3 CPI, averaging 3.7% yr/yr, significantly exceeded July’s 3.3% projection. Q3 GDP appears to be tracking below

October 06, 2023

Canada September Employment: Unimpressive Detail but BoC Tightening Risks Increase

October 6, 2023 1:30 PM UTC

Most of the rise in employment came from a 47.9k increase in part time work, with full time up a moderate 15.8k. The public sector with a rise of 36.6k also explained over half of the increase. With self-employment up by 26.1k private sector employment increased by a minimal 1.1k. Educational servic

September 06, 2023

Bank of Canada Pauses as GDP Slips but Remains Worried About Inflation

September 6, 2023 2:47 PM UTC

The BoC stated that given signs of easing excess demand and given policy lags they decided to hold the rate at 5.0% but they go on to say that they are concerned about persistent underling inflationary pressures and are prepared to tighten further if needed. While we expect the BoC to keep rates at

September 01, 2023

Subdued Underlying Canadian GDP Picture Justifies a BoC Rates Pause

September 1, 2023 1:33 PM UTC

Household consumption slowed to a 0.2% pace from 4.7% in Q1 as retail sales data had already implied. The consumer picture has been generally subdued apart from a very strong January inflated by mild weather. Gross fixed capital formation rise by 1.6% after a 5.3% Q1 decline, and given that housing

August 29, 2023

Bank of Canada to Hold Rates on September 6, Awaiting Further Data

August 29, 2023 5:40 PM UTC

The Bank of Canada meets on September 6 and looks likely to leave rates at 5.0%, after tightening by 25bps in its preceding two meetings, assuming Q2 GDP data due on September 1 shows the expected signs of slowing. The statement however is likely to make it clear that further tightening is possible

July 12, 2023

Bank of Canada Would Consider Tightening Further if Inflation Remains Stubborn

July 12, 2023 4:22 PM UTC

The statement welcomed a slower May CPI outcome but saw downward momentum in inflation as largely from energy. It added that with three-month core rates rising around 3.5-4.5% since September underlying price pressures appear more persistent than anticipated. The BoC now sees inflation running aroun

July 03, 2023

Bank of Canada Preview: Close Call For a 25bps Tightening

July 3, 2023 3:12 PM UTC

After tightening by 425bps to 4.50% in the 12 months to January 2023, the BoC paused at its March and April meetings, before resuming tightening with a 25bps move in June. The statement released in June noted stronger than expected data from both growth and inflation and concluded that policy was no

June 21, 2023

BoC June Deliberations Focused on Consumer and Core Inflation Strength

June 21, 2023 6:04 PM UTC

Global growth as seen as moving in line with expectations but resilience in core inflation, and in North America, consumer spending, was noted. Turning to Canada, the BoC stressed the strength of consumption within the stronger than expected Q1 GDP release but did see some signs of easing in labor m

June 07, 2023

Bank of Canada Resumes Tightening, Hawkish Tone Suggests Scope For More

June 7, 2023 2:43 PM UTC

In detailing a stronger than expected 3.1% annualized rise in GDP the BoC notes strength in consumption, increasing demand for interest-sensitive goods and a pick-up in housing activity, before going onto note labor market strength and concluding that excess demand looks more persistent than anticip

May 31, 2023

Bank of Canada Preview for June 7: Maintaining a Tightening Bias

May 31, 2023 4:08 PM UTC

The policy rate currently stands at 4.5%, with the last two meetings, on March 8 and April 12, having seen rates left unchanged. Since the April 12 meeting Canadian CPI slipped from 5.2% in February to 4.3% in March, but unexpectedly corrected higher to 4.4% in April. The core rates did however cont

February 22, 2023

In-Depth Research: Quick Roadmap Central Bank Forecast/Rationale - February 2023

February 22, 2023 10:44 AM UTC

M/T Quick Roadmap – Fundamental MMKT/CB Roadmap and Rationale

February 2023

US FEDERAL RESERVE

The February 1 December FOMC meeting saw the pace of tightening slowed to 25bps. Inflation has slowed, but January's CPI details still show broad based inflationary pressures at a pace well above the Fed's