Brazilian Central Bank

View:

May 09, 2024

BCB Review: 25bps Cut, No Additional Guidance

May 9, 2024 1:11 PM UTC

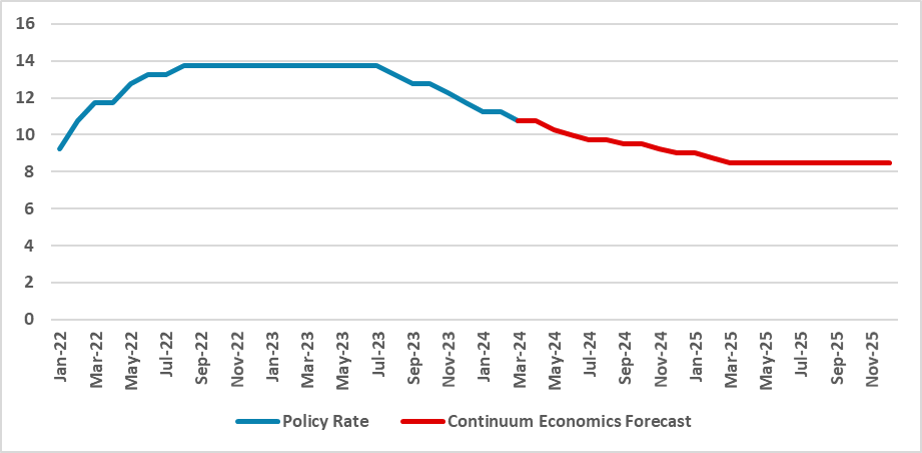

The Brazilian Central Bank convened, opting against a 50bps cut, reducing it to 25bps, lowering the policy rate to 10.5%. A split vote ensued, with 25bps winning 5x4. The communique, vague possibly due to board division, noted labor market and economic activity surpassing expectations. Foreign marke

May 06, 2024

BCB Preview: 25bps or 50bps cut?

May 6, 2024 1:02 PM UTC

The Brazilian Central Bank (BCB) convenes on May 8 to set the policy rate. Previous forward guidance hinted at a 50bps cut in May, but recent statements from BCB President Roberto and some weakness in the BRL have shifted expectations to a 25bps cut. However, we anticipate the BCB maintaining a 50bp

May 03, 2024

EMFX: Diverging On Domestic Forces Not Less Fed Easing Hopes

May 3, 2024 10:45 AM UTC

While U.S. economic developments, plus Fed policy prospects, will be important in terms of EM currency developments, domestic politics and fundamentals will also be decisive. These can keep the South Africa Rand volatile in the remainder of 2024, given the risk of a coalition government and African

May 02, 2024

Moody’s Improves Outlook Perspective Due to Higher Growth

May 2, 2024 2:27 PM UTC

Moody’s upgraded Brazil's outlook to positive from stable, maintaining its Ba2 rating, signaling a potential move to Ba1 soon. Strong growth prospects, attributed to institutional reforms, drove this shift. Despite lingering doubts, improved fiscal conditions and anticipated tax reform are bolster

April 26, 2024

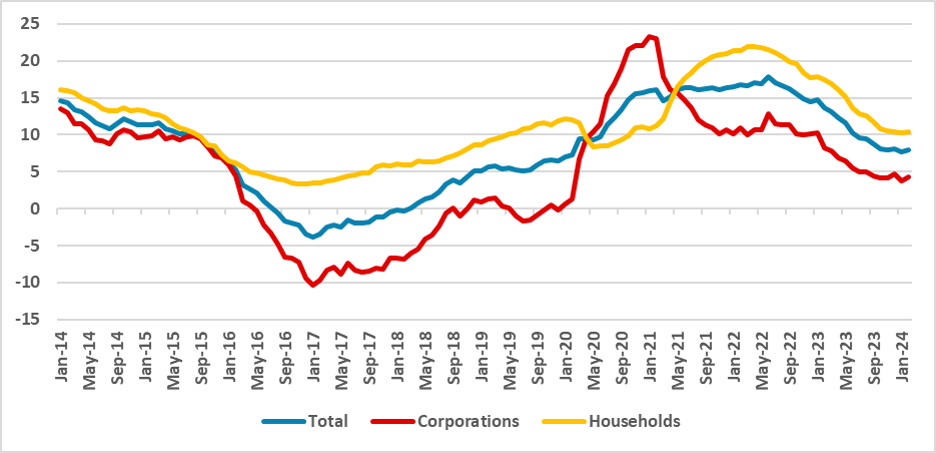

Brazil: Credit Decelerating Amid Tighter Conditions

April 26, 2024 1:21 PM UTC

Despite the BCB's initiation of the cutting cycle, credit is anticipated to decelerate due to monetary policy lags. Enterprises face the most significant impact, with nominal growth dropping to 4.1% in February from 12.1% a year prior. While household credit growth slows to 10.4% annually from 17%,

April 24, 2024

Brazil: Wage Inflation Will Likely Not Be a Big Deal

April 24, 2024 3:19 PM UTC

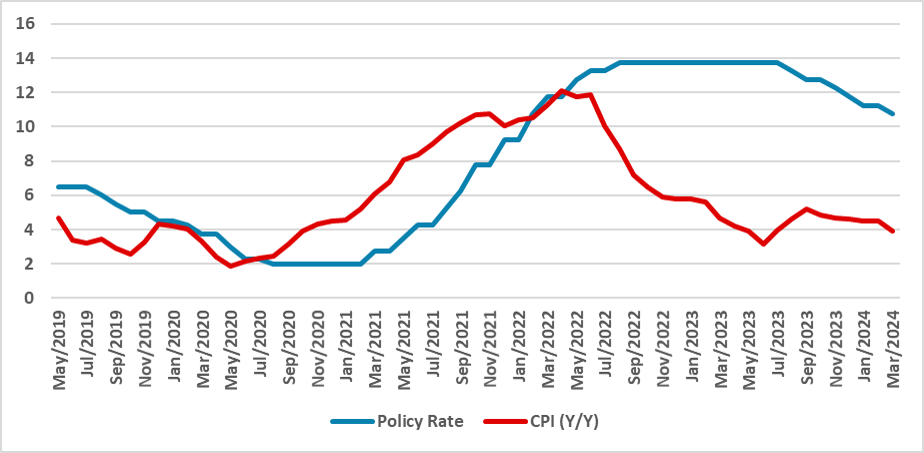

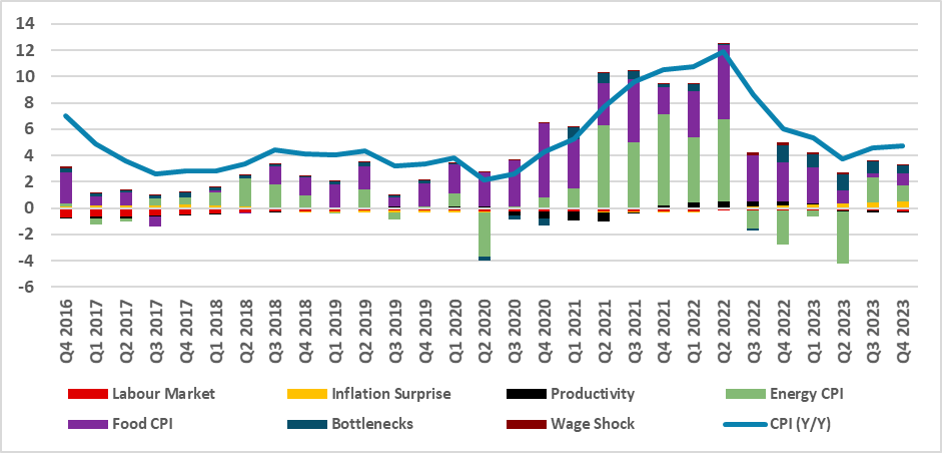

Our analysis delves into recent trends in the Brazilian labor market, focusing on CPI and wage inflation. Utilizing a model akin to Ghomi et al. (2024) and Blanchard and Bernanke (2023), we dissect recent spikes in wage inflation and CPI growth. Notably, our findings suggest that recent wage spikes

April 18, 2024

Brazil: Revision of Targets Shows the Weakness of the New Fiscal Framework

April 18, 2024 1:39 PM UTC

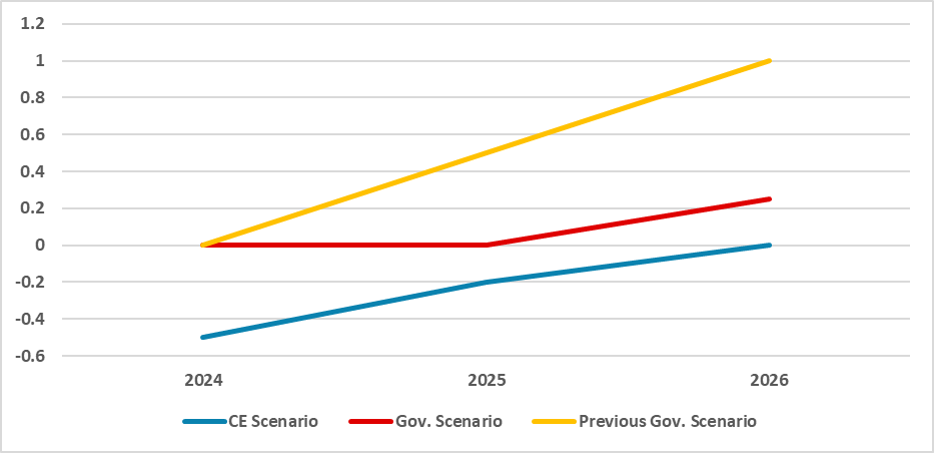

The Brazilian government has revised its budget targets for 2025 and 2026, lowering the deficit to 0% and a 0.25% surplus in 2025 and 2026 respectively, from 0.5% surplus in 2025 and 1% in 2026. However, reliance on revenue increases poses challenges amid resistance from Congress. Despite reduced ta

April 03, 2024

Brazil: What About the Fiscal?

April 3, 2024 2:31 PM UTC

In 2023, Brazil witnessed a significant fiscal decline, with the GDP surplus of 0.5% in 2022 turning into a 2.1% deficit, surpassing the targeted 0.5% deficit set by the new fiscal rule. Despite measures aimed at reinstating fiscal sustainability, immediate adjustments are unlikely. The deterioratio

March 28, 2024

Brazil: Inflation Report Points to a Scenario Too Good for the BCB Board to Believe it

March 28, 2024 2:20 PM UTC

The Brazilian Central Bank's Quarterly Inflation Report reflects uncertainty over disinflation and emphasizes caution in monetary policy. Despite slower expected disinflation and inflationary surprises in certain sectors, the BCB projects optimism with inflation nearing target. Labor market data sho

March 26, 2024

BCB Minutes: Doors Opens to Diminish the Cuts Pace in June

March 26, 2024 1:11 PM UTC

The Brazilian Central Bank has released the minutes of their last minutes. The minutes highlighted the uncertainty, labour market pressures and unanchored expectations. They decided to reduce the horizon of the 50bps ace to the May meeting which indicates a prospective reduction to diminish the pace

March 22, 2024

LatAm Outlook: Getting Deeper in the Cutting Cycle

March 22, 2024 7:04 PM UTC

· Brazil and Mexico growth will decelerate from the growth rates seen in 2023. The stronger basis of comparisons in 2023 and the tight monetary policy will diminish growth during 2024. Brazil robust agricultural growth will not repeat in 2024, while Mexico growth is restrained by a tigh

March 21, 2024

BCB Review: Forward Guidance Kept but Chance to be Taken Out Soon

March 21, 2024 12:50 PM UTC

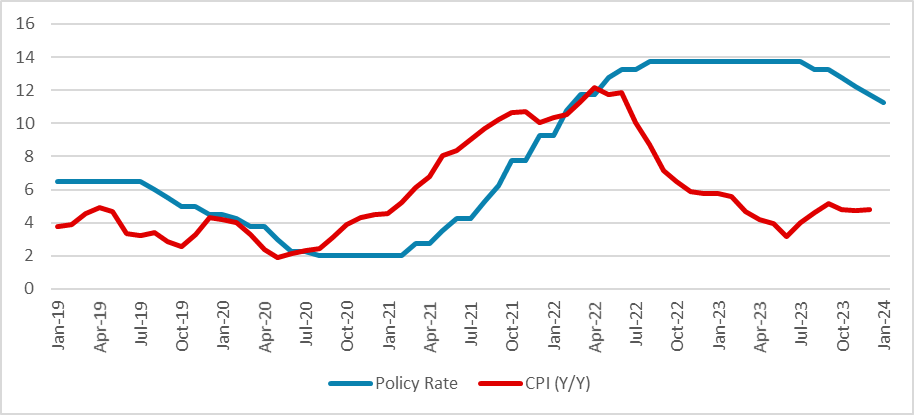

The Central Bank (BCB) slashed the policy rate by 50bps to 10.75%, with further cuts anticipated. Medium-term easing hinges on inflation dynamics and economic factors. The BCB's forward guidance suggests a potential shift in communication and cut magnitude by June, changing the cut pace to 25bps fro

March 18, 2024

BCB Preview: 50bps Cut and Softer Forward Guidance

March 18, 2024 4:48 PM UTC

The Brazilian Central Bank is anticipated to cut the policy rate by 50bps, reaching 10.75%, amidst easing inflation and cautious market sentiment. The recent surge in food prices raises concerns, while the BCB is expected to abandon its usual forward guidance in favor of more data-driven decisions.

March 08, 2024

Brazil CPI Preview: 0.7% in February will likely be only a Transitory Problem

March 8, 2024 8:56 PM UTC

IBGE will release February's CPI data on Mar. 12, forecasting a 0.7% increase, driven mainly by education and food sectors. While some rises may persist, they're not indicative of a general price surge. Despite a 0.7% rise, Y/Y CPI is expected to drop to 4.4%, aligning with BCB targets. Forecasts su

February 28, 2024

Brazil GDP Preview: Small Contraction in the Last Quarter

February 28, 2024 2:51 PM UTC

The Brazilian GDP is anticipated to have contracted by 0.1% in Q4 2023, yet the annual growth for 2023 is expected at 3.1%, marking the third consecutive year above the 3.0% threshold. Agricultural sector's significant 15% growth, primarily driven by soybean harvest, offsets the deceleration. Tight

February 22, 2024

EMFX: Carry and Domestic Fundamentals Rather Than the USD

February 22, 2024 10:00 AM UTC

Bottom Line: Most major EMFX currencies have performed better than the Euro or the Japanese Yen against the USD in 2024 (Figure 1). This is due to carry trades in Latam, but elsewhere reflects global equity love on Indian equities or domestic fundamentals. This resilience for Brazilian Real/Indi

February 06, 2024

BCB Minutes: Caution within the Easing Cycle

February 6, 2024 1:22 PM UTC

The BCB released minutes detailing the 50bps cut to SELIC, shedding light on monitored risks. Despite a unanimous vote, differences in language emerged, especially regarding variables. Notably, new government-appointed members were present. Internationally, the board noted minimal impact from Fed de

February 01, 2024

BCB Review: 50Bps Cut Maintained

February 1, 2024 2:36 PM UTC

The Brazilian Central Bank (BCB) maintained a widely expected 50bps cut in the policy rate, bringing it down to 11.25% from 11.75%. The BCB's neutral communique highlighted caution in emerging economies amid global monetary tightening. The domestic scenario, aligned with contractionary policies, saw

January 29, 2024

BCB Preview: 50 bps Cut to Be Kept but Caution in the Communique

January 29, 2024 8:51 PM UTC

The Brazilian Central Bank is expected to continue cutting interest rates on January 31, aiming to address the overly contractionary policy rate of 11.75%. In the face of persistent inflation around 4%-5%, concerns include El Niño's impact on food prices and uncertainties in services inflation. Fis

December 20, 2023

BCB Minutes: Conservative Approach to the Inflation Battle

December 20, 2023 11:16 AM UTC

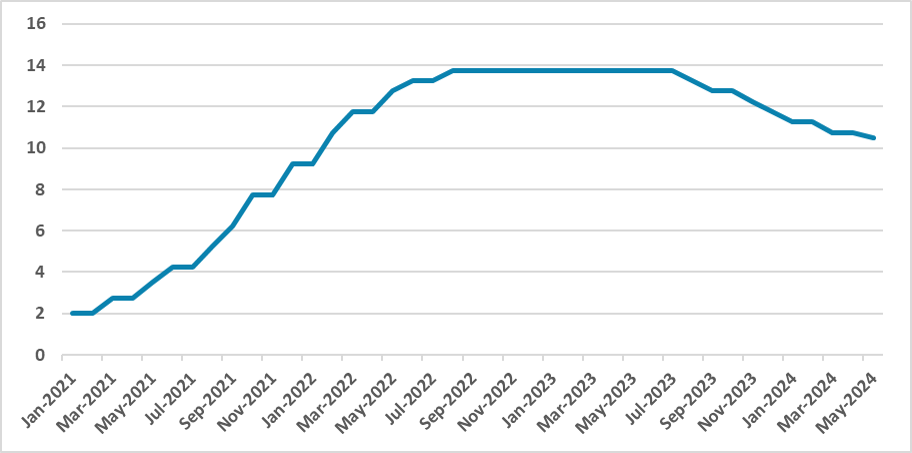

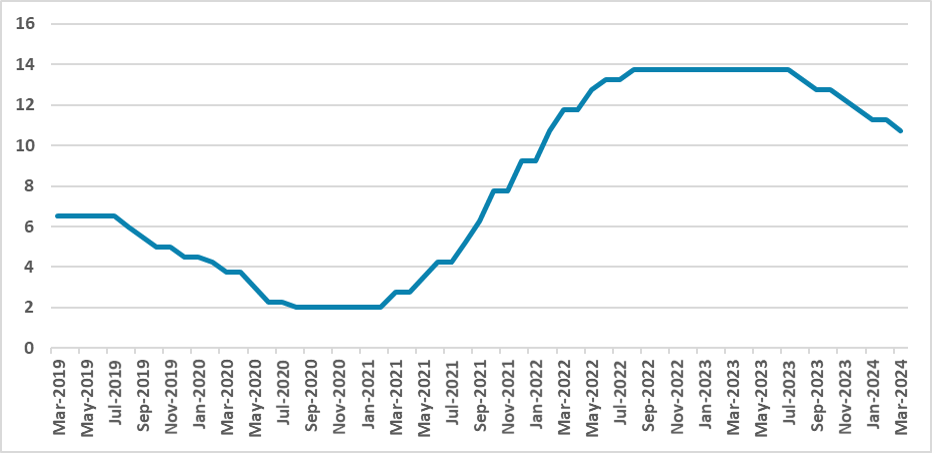

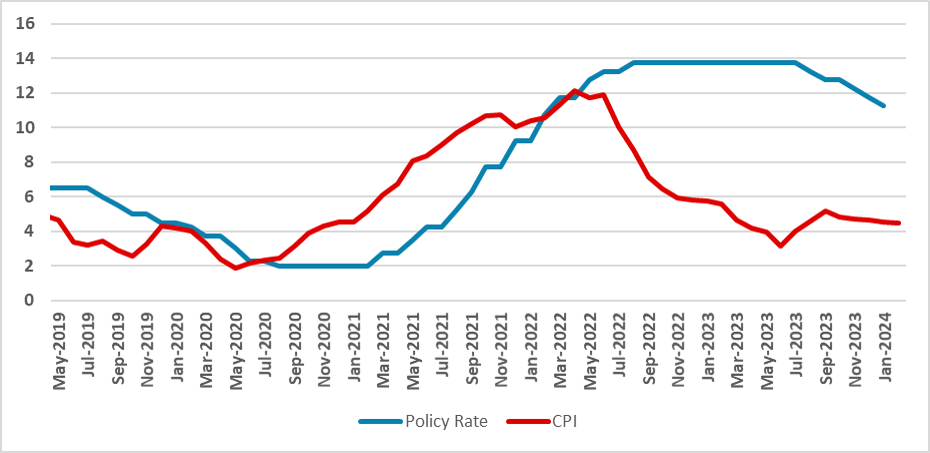

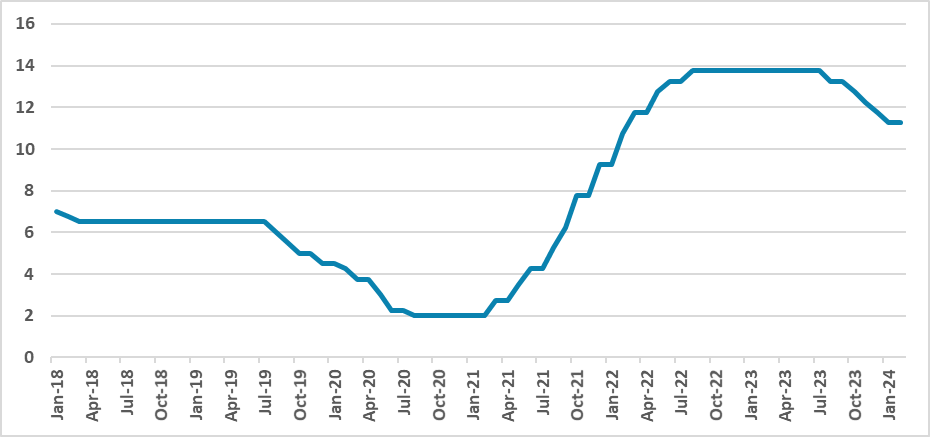

Figure 1: Brazil Policy Rate (%)Source: BCB and Continuum Economics

The Brazilian Central Bank has released the minutes of its recent meeting, during which it lowered the policy rate by 50 basis points to 11.75%, in line with market expectations. As customary for the BCB, the minutes took a conservat

December 15, 2023

LatAm Outlook: Diverging Paths in 2024

December 15, 2023 12:25 PM UTC

Our Forecasts

Risks to Our Views

Source: Continuum Economics

Brazil: Switching Back to Slow Growth?

Brazil growth has finally begun to decelerate (here), as the growth in the third quarter dropped to 0.1% (q/q). However, growth for 2023 is expected to stand at 3.2% (Yr/Yr) which is quite a bit higher th

November 29, 2023

Brazil: The 0% Deficit Tale is About to be Forgotten

November 29, 2023 7:47 PM UTC

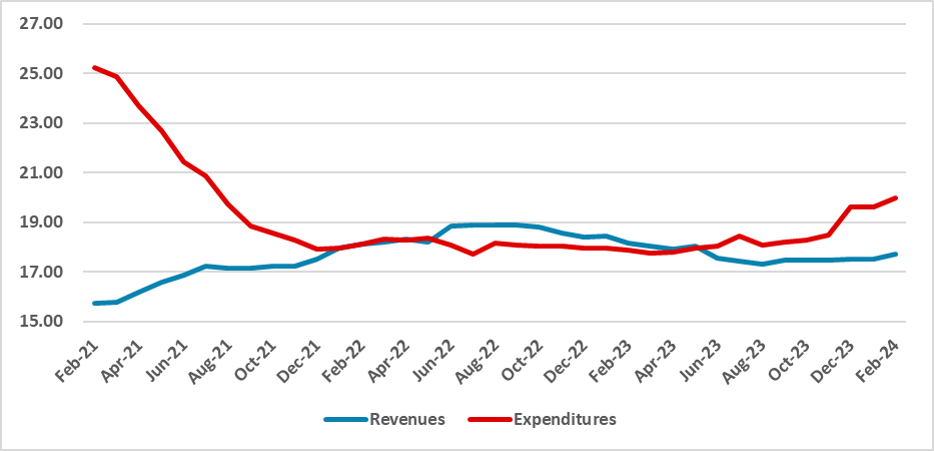

When Finance Minister Fernando Haddad unveiled the New Fiscal Framework, capping expenditure growth at 70% of revenue growth, he anticipated a sustained increase in revenue in line with the rates observed in 2021 and 2022. The objective was to keep expenditures below revenues, ensuring fiscal adjust

November 24, 2023

LatAm: Long Term Growth Differences

November 24, 2023 11:52 AM UTC

We see different patterns of growth for the Latin American countries. Brazil, Mexico and Argentina have different types of constraints that will define their long-term growth.

Figure 1: Annual GDP Growth

Source: Continuum Economics. *forecasts

We observe that the long-term growth trajectory for Brazil

November 22, 2023

El niño impacts on Latin America: a headwind for Brazil

November 22, 2023 11:30 AM UTC

El Niño is a climate pattern that makes Pacific Ocean waters warmer and, consequently, triggers extreme weather conditions in Latin America (LatAm) economies. However, its impacts among the LatAm countries varies. In some regions, this climate phenomenon causes severe droughts, impacting agricultur

September 28, 2023

LatAm Outlook: Growth Continues

September 28, 2023 8:46 PM UTC

Our Forecasts

Risks to Our Views

Source: Continuum Economics

Brazil: Brighter than Expected

The Brazilian economy has surpassed expectations in the first half of this year. In the initial quarter, robust growth was predominantly driven by an exceptional surge in the agricultural sector, as soybean produ

September 07, 2023

Brazil: Drop on Revenues Leads to Fiscal Deterioration

September 7, 2023 1:47 PM UTC

Figure 1: Primary Expenditures and Revenues (% of the GDP, 12-months sum)

Source: STN and BCB

The fiscal situation in Brazil has recently deteriorated significantly. In 2022, the country boasted a 0.6% primary surplus, but by July, this figure had plummeted to a 0.9% deficit. This alarming shift can

June 21, 2023

LatAm Outlook: Lower Inflation and Growth above Expectations

June 21, 2023 9:27 AM UTC

Our Forecasts

Risks to Our Views

Source: Continuum Economics

Brazil: Higher Agricultural Production and Lower Inflation

The Brazilian economy experienced robust growth in the first quarter of 2023, with a notable expansion of 1.9% quarter-on-quarter (here). This growth was primarily driven by a remarkab

May 30, 2023

Brazil: Reindustrialization through Subsidies

May 30, 2023 1:11 PM UTC

Figure 1: Industry Participation on the GDP

Source: IBGE and Continuum Economics

The Brazilian government recently introduced a set of measures aimed at revitalizing the automotive sector. These measures primarily involve offering subsidies for car production, with a focus on reducing federal taxes to

May 23, 2023

Brazil: Petrobras Changes its Fuel Price Policy. Who Pays for it?

May 23, 2023 2:09 PM UTC

Figure 1: Petrobras Distribution Prices, International oil Prices and Gasoline CPI (Aug-2019 = 100)

Source: Petrobras, IBGE and Datastream

Petrobras has recently announced a significant change to its fuel pricing policy. Since 2016, the state-owned company had been following a practice of aligning its

May 18, 2023

Brazil: Activity Data Paints a Bleak Picture

May 18, 2023 1:40 PM UTC

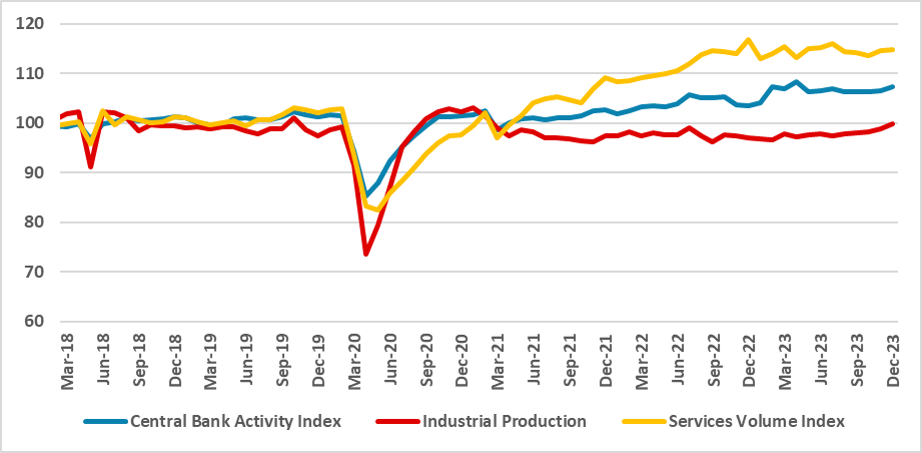

Figure 1: Activity Indicators (2019 = 100, Seasonally Adjusted)

Source: IBGE

The major activity indicators in Brazil, including the industrial production Index, services volume, and retail trade, suggest that the country's economic activity is expected to remain close to a stagnant state. While these

April 27, 2023

Latam Trade Outlook: Very Different Patterns

April 27, 2023 1:06 PM UTC

Mexico:

Figure 1: Mexico Exports and Imports (12 months sum, USD Bn)

Source: INEGI

Mexico’s main trading partner is the United States, which corresponds to 80% of their exports values. Additionally, Mexico is a relatively open economy as trade corresponds to around 40% of Mexican GDP. The main story

April 20, 2023

Brazil: Fiscal Framework Sent to Congress

April 20, 2023 4:19 PM UTC

The Brazilian Government has sent to the Congress the final text of the New Fiscal Framework (here). The measure would restrict the growth to 70% for Revenue Growth, set bands for the primary target and in case the primary target is above the stipulated, the government could use the extra revenues t

March 30, 2023

Brazil: New Fiscal Framework Revealed

March 30, 2023 8:18 PM UTC

Figure 1: Fiscal Result Target (% of GDP)

Source: Ministerio da Fazenda

Brazil’s Finance Minister Mr. Fernando Haddad has revealed in a press conference the new fiscal framework which will substitute the Expenditure Ceiling Rule. The new rule will be more flexible than the Expenditure Ceiling but st

March 24, 2023

LatAm Outlook: Putting the Gears Down

March 24, 2023 3:09 PM UTC

Our Forecasts

Risks to Our Views

Source: Continuum Economics

Brazil: Handbrakes on

The Brazilian economy has begun to show signs of deceleration as the effects of the contractionary policy are starting to be felt. Q4 GDP (here) has marginally contracted (-0.2% q/q), and the strong impetus that the servi

September 09, 2022

EM FX: USD Strength but Not Crisis

September 9, 2022 1:01 AM UTC

Figure 1: USD Rises More Slowly against Key EMs and Falls vs. Brazilian Real (Dec. 31, 2021 = 100)

Source: Continuum Economics

The USD surge against G10 currencies has not been replicated so far against bigger EM currencies for a number of reasons. Key points include:

Figure 2: 10yr Nominal Yield Spre

August 10, 2022

EM Relief from Peak Fed Rates?

August 10, 2022 8:20 AM UTC

Figure 1: USD Real Effective Exchange Rate (2010 = 100)

Source: Datastream, Continuum Economics

Fed Peaking and EM FX and Bond Yields

Financial markets are now discounting that the Fed will finish tightening by the December FOMC meeting, and our June Outlook (here) highlighted the view that we will s

July 14, 2022

Brazil: 3 Scenarios for Post-elections Brazil

July 14, 2022 1:17 PM UTC

Figure 1: Vote Intentions Polls

Source: FSB/BTG

The latest polls in Brazil show a two-horse race between incumbent Jair Bolsonaro and former President Luiz Inácio Lula da Silva for the presidential election in October. Lula holds a 10 ppt advantage over Bolsonaro and is the clear favorite to regain t

June 17, 2022

LatAm Outlook: Real Wage Squeeze Hits Consumption

June 17, 2022 10:44 AM UTC

Our Forecasts

Source: Continuum Economics

Risks to Our Views

Source: Continuum Economics

Brazil: Consumer Recession Risks and Less BCB Easing

The really bad news is that Brazil faces a big real wage squeeze in 2022. We project CPI inflation to average 10.0% in 2022, due to the feedthrough of energy and